- Joined

- 26 October 2006

- Posts

- 327

- Reactions

- 0

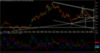

Waiting for a CFD long trade in (ERA) at the moment. Probably has hit its intermediate bottom and is looking to go higher from here. Nice little double bottom shaping up with very nice divergence in OBV and MACD.

Lachlan

Would you say this is now an inverted head and shoulders, now?

What do the other indicators tell you about future movement?