ENG - Engin Limited

- Thread starter Duckman#72

- Start date

- Joined

- 14 November 2005

- Posts

- 1,319

- Reactions

- 12

Fab said:I am actually surprised it did not open above 40c. I see this announcement as a very good news for ENG. I might top up if it stays below 40c

Don't forget - the financials are nothing to write home about. At the moment you are still just buying "potential".

The Seven deal is great for ENG - but what has actually happened? They've just diluted the share base. Do you really think that the share price would have risen by up to 30% overnight based on an announcement that a company that is not "'acquiring"' any revenue or tangible income. Sure they have a "heavyweight" on board but they still need to start producing some solid results (read $$$$$$$$$$$).

Another way to look at it - ENG has entered into a very expensive advertising deal with Seven.

However I would like to add - I'd rather be on ENG than BRO!!!

Duckman

Duckman#72 ,

I think you are making some good points there. I am actually happy that Telstra will get some competition so as I am sick of their monopolistic attitude.

Telephony and media seems to be a very good mix . VOIP has done very well in Europe and the states, Australia behind at the back of the OECD pack with regards to broadband speed and therefore voip intake I don't why ENG won't increase its market share in the near future. It is still a question of bilding a client base at the moment for them and some brand awareness which the Seven deal will greatly help. Hopefully we will see so great $$$ figures coming through their balance sheet in the future. I also like the sound of the change of directors. Looks like a worthy share to back in my opinion.

I think you are making some good points there. I am actually happy that Telstra will get some competition so as I am sick of their monopolistic attitude.

Telephony and media seems to be a very good mix . VOIP has done very well in Europe and the states, Australia behind at the back of the OECD pack with regards to broadband speed and therefore voip intake I don't why ENG won't increase its market share in the near future. It is still a question of bilding a client base at the moment for them and some brand awareness which the Seven deal will greatly help. Hopefully we will see so great $$$ figures coming through their balance sheet in the future. I also like the sound of the change of directors. Looks like a worthy share to back in my opinion.

"The Chairman of Engin Ltd, Mr Will Jephcott, said: "This proposal is a watershed event for Engin and a landmark change for communications in Australia. This strategic relationship will enable Engin to strengthen its market leading internet telephony business and draws on Seven’s content and digital media experience to create an important broadband gateway that delivers competitive services to all Australians.”

WTF does that mean? Can someone give me a simple explanation on why this is such a watershed event?

WTF does that mean? Can someone give me a simple explanation on why this is such a watershed event?

- Joined

- 10 January 2006

- Posts

- 133

- Reactions

- 0

Duckman#72 said:However I would like to add - I'd rather be on ENG than BRO!!!

Duckman

Thank you, that'll do.....for now

Fab

results were published last week

on the same day as the SEVEN deal was struck

the financials have shown the profitability of the company has not improved, despite more customers, in fact the profitability has worsened

see the market release

however

the income is grossly up

the staff costs are flat

it is more the marketing costs and disposable costs which have increased

of course if staff costs remain the same

and income grows at the same rate

and there is no significant changes in consumables and marketing

the company is on track for profitability

ij

results were published last week

on the same day as the SEVEN deal was struck

the financials have shown the profitability of the company has not improved, despite more customers, in fact the profitability has worsened

see the market release

however

the income is grossly up

the staff costs are flat

it is more the marketing costs and disposable costs which have increased

of course if staff costs remain the same

and income grows at the same rate

and there is no significant changes in consumables and marketing

the company is on track for profitability

ij

Fab said:Thanks ijudge ,

SPP keeps on going down. Never mind I believe this is the right way to go for ENG.

Yes I must say that is has been quite disappointing the direction the sp has taken today.. but this is definitely the right direction for the company. I'll still be holding and hoping

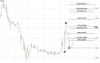

Could this be a turning point for 6 down days...?????

Volumes don't look great, but better than the last couple of days...

If it breaks above the 50% in days to follow, it may reach above the last high...BUT hey I'm only new at this...

Any thoughts...from the more exp traders...

Volumes don't look great, but better than the last couple of days...

If it breaks above the 50% in days to follow, it may reach above the last high...BUT hey I'm only new at this...

Any thoughts...from the more exp traders...

Attachments

- Joined

- 30 June 2006

- Posts

- 16

- Reactions

- 0

Not to say I told you so, but...

Too many trading on this as a spec stock. And waiting for that break even. When trading specs you need that carrot. I see no carrot now. No carrot.

Too many trading on this as a spec stock. And waiting for that break even. When trading specs you need that carrot. I see no carrot now. No carrot.

Not sure why BrownHornet is being so negative but i would have to say eng is a strong buy at these levels. I dont think it is as speculative now that channel 7 are on board. Technically has just broken out of its base and there is accumulation at these levels. Although it would be good to see higher volumes and was a bit disappointed it didnt finish at its high yesterday.

Totally agree with you Fab, ENG has a very very bright future no doubt about it. There is never many posts on stocks when they are consolidating or going down.

Nice hammer reversal today. ENG will move north very soon, and it will go up very fast.

Nice hammer reversal today. ENG will move north very soon, and it will go up very fast.

roxy said:Nice hammer reversal today. ENG will move north very soon, and it will go up very fast.

Hi roxy,

Could you briefly explain hammer reversal, and what timeframe this pattern will have on stock price....

Or reference me to a good link with different patterns...

Thanks

SevenFX

As I am new to this game could someone explain to me were the 109,452,662 shares @ $0.215 actually come from and what impact this has in the short term to the currant share price. Dos this mean the share price drops to this price when this happens or what? No matter what the answer is I still beleive this company is a great investment and we will be rewarded for hanging in there.

Arrow said:No matter what the answer is I still beleive this company is a great investment and we will be rewarded for hanging in there.

The question is for how long should one hold these, as lost opportunity costs, and if your leveraged on these, well that costs as well.

No doubt shares like these could double & triple over time (weeks, months, years), but so could many others.....and they could also fall below 0.25cents support and make a bad situtation worse...???

I think the lesson here for me is to get out early, and buy back in again when it moving north.

- Joined

- 9 May 2006

- Posts

- 155

- Reactions

- 0

There was mention of IP Telephony in the Telstra update.

"It forecast annual revenue growth of 2-2.5 per cent on the back of increased revenues from 3G and IP telephony, which was expected to offset losses from adverse regulatory outcomes."

Will this have any impacts on ENG? What are your thoughts?

"It forecast annual revenue growth of 2-2.5 per cent on the back of increased revenues from 3G and IP telephony, which was expected to offset losses from adverse regulatory outcomes."

Will this have any impacts on ENG? What are your thoughts?

Similar threads

- Replies

- 16

- Views

- 3K