- Joined

- 28 March 2006

- Posts

- 3,576

- Reactions

- 1,335

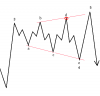

Completed impulse wave down and now wave a of an abc up?A very interesting picture that's recently developed on the XAO, which may be a key pattern to the long climb from the 2009 low....

A very interesting picture that's recently developed on the XAO, which may be a key pattern to the long climb from the 2009 low....

The first leg of an upwards correction should be near completion.... assuming for an a-b-c flat or zigzag correction that takes the XAO to a 50% or 61.8% retrace before continuing downwards...

The XAO continues to exhibit a 'terminal impulse' pattern (aka ending diagonal) with wave (i) of the 5th wave complete and wave (ii) down underway, maybe to around the 6500-6533 range. This zoomed in hourly chart shows the details of the smaller waves within the larger wave 5 (from June 3rd) with approximations of what this terminal impulse could look like. Obviously a significant departure from the stated pattern would reduce the priority of this final terminal impulse pattern (eg if significant top is already in).

It should be noted that there are x2 terminal impulse patterns underway, a 'assumed' smaller 5th wave terminal impulse as waves (i)-(v), which makes up wave v of the larger waves i-v, also a terminal impulse. The smaller terminal impulse could also trend sideways and overlap the lower ii-iv trend line, thus a new high would fail to materialise.

View attachment 95516

please show us your "alternate" labelling

... the XAO moved a little quicker that anticipated and has now reached the critical point as discussed on 21st May. The larger terminal impulse pattern, wave 5, from Jun 11th looks complete with some potential to 'throw over' the long term trendline.

....The DOW also needs to push up above the high set in Oct 2018 to complete wave D of an expanding triangle. It too has a completed 4th wave triangle on the hourly chart that implies a change in trend is at hand at least for the the short term - both indexes remain in sync for the short term trend.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.