- Joined

- 31 March 2015

- Posts

- 477

- Reactions

- 865

Porper. I enjoyed it as well, even the time thereafter I enjoyed in it's application. However in this learning process I only found 2 or 3 EW patterns that could be used consistently. The hardest to find was the 3rd wave, because just as you thought a 3rd wave was about to start or even continue in the direction of the trend by counting something else would happen. Only on rare occasions I was able to find the 3rd wave early.

Once you realize it's a 3rd wave nearly every other trader does too or at least that it's a descent move and then everybody jumps in.

I didn't start hitting my stride until I left EWI because I started trading "what I saw" instead of following the advice of Prechter and others there. The reason for this because I started looking at the market with an open mind and did not think in terms of the EWP only. I developed my own cycles approach and I find trades every single day off 1 hr, 4hr and 8Hr charts.

With EW need to wait until specific counts or patterns set up and some times these can be few and far between, but ofcourse I still lookout for them.

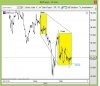

To be honest I find more trades using harmonic patterns like Gartleys etc than EW patterns. I try and keep it simple with these harmonic patterns, firstly they must be symmetrical and as close as textbook as possible. I don't like them skewed, I keep away from those. I know a lot of other traders that trade anything closely resembling these harmonic patterns but they are only correct 20-30% of the time wheareas filtering and only talking the best looking setups will give on much better strike rate.

Once you realize it's a 3rd wave nearly every other trader does too or at least that it's a descent move and then everybody jumps in.

I didn't start hitting my stride until I left EWI because I started trading "what I saw" instead of following the advice of Prechter and others there. The reason for this because I started looking at the market with an open mind and did not think in terms of the EWP only. I developed my own cycles approach and I find trades every single day off 1 hr, 4hr and 8Hr charts.

With EW need to wait until specific counts or patterns set up and some times these can be few and far between, but ofcourse I still lookout for them.

To be honest I find more trades using harmonic patterns like Gartleys etc than EW patterns. I try and keep it simple with these harmonic patterns, firstly they must be symmetrical and as close as textbook as possible. I don't like them skewed, I keep away from those. I know a lot of other traders that trade anything closely resembling these harmonic patterns but they are only correct 20-30% of the time wheareas filtering and only talking the best looking setups will give on much better strike rate.