- Joined

- 20 July 2021

- Posts

- 11,832

- Reactions

- 16,483

run out of crude probably not , difficulty supplying petrol and diesel ( and kerosene ) to the pumps MAYBE

BPT has several capped wells waiting to go into production ( i assume waiting for an attractive price ) , i would guess some other players would have some capped wells also , HOWEVER several older refineries are being repurposed into storage facilities , and we MIGHT have a transport problem coming to boot

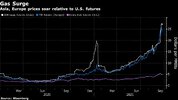

now gas will depend on how much we export ( and how much is kept for local consumption )

BPT has several capped wells waiting to go into production ( i assume waiting for an attractive price ) , i would guess some other players would have some capped wells also , HOWEVER several older refineries are being repurposed into storage facilities , and we MIGHT have a transport problem coming to boot

now gas will depend on how much we export ( and how much is kept for local consumption )