- Joined

- 12 January 2008

- Posts

- 7,395

- Reactions

- 18,487

LOL, thought you'd have a good week also. Your posts remind me to trade the price action not what I think may happen.

keeping an accurate record is essential for those interested in following the journey.

Maybe a rolling year if week now -53 was very good and better than the last week, last week gain are belowthose a year ago and the rolling year is lower.@Nick Radge, would you please confirm if your posted records are accurate?

Keeping accurate records is not only important, but it is also crucial for individuals who are interested in tracking your progress. By maintaining accurate records, you can effectively monitor your growth, identify areas that require improvement, & stay organised throughout the journey.

If the records are accurate, how are they achieved?

By having a comprehensive & accurate record of your journey, you'll have a valuable resource to refer back to whenever you need it. It can provide insights into your strengths & weaknesses, which will help you in setting realistic goals, & keep you accountable in achieving them. So, make it a habit to keep accurate records & watch how it helps you achieve your desired results more efficiently.

View attachment 155788

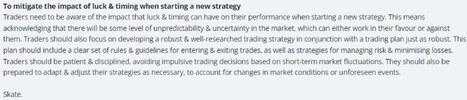

Skate.

or just error

It is mind boggling how much money you can extract from the market as a retail trader, with the right amount of discipline, fortitude and conviction.

They may need to invest in better tools or software to assist with tracking & reporting, or consider hiring a professional to manage their records.

To mitigate the impact of luck & timing when starting a new strategy

Of course, it could be as simple as a withdrawal made this week wasn't copied down in the Excel sheet? Imagine that...

Wow...imagine, Nick Radge does a presentation on this exact topic and old mate here starts singing the same song two days later. FFS.

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

I stand to be corrected

@qldfrog, keeping accurate records is an essential aspect of any trader, & it seems that "The Chartists" have fallen short in this regard. Not only is their weekly profit & loss (P&L) reporting incorrect, but they also seem to struggle with basic arithmetic when summing up their daily totals. The importance of accurate record-keeping cannot be overstated, particularly in the financial industry where even the slightest error can have significant consequences. Precise records provide valuable information that can help identify trends, track progress, & make informed decisions.

In conclusion

It's crucial for "The Chartists" to improve their record-keeping practices to ensure that their financial analysis is reliable & trustworthy. They may need to invest in better tools or software to assist with tracking & reporting, or consider hiring a professional to manage their records. Accurate record-keeping is a fundamental aspect of any endeavor, & "The Chartists" must address their shortcomings in this area to ensure their financial analysis is accurate & reliable.

View attachment 155789

Skate.

Nineteen bucks !! Whats the agenda here.... ?? Bit weird.....

Accurate record-keeping is a fundamental aspect of any endeavor, & "The Chartists" must address their shortcomings in this area to ensure their financial analysis is accurate & reliable.

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

www.aussiestockforums.com

It's 19 dollars !! I dont want to "forget the dollar figure involved"Forget the dollar figure involved

is weird. What do you carerecord-keeping practices

It's 19 dollars !! I dont want to "forget the dollar figure involved"

@Sir Burr it wouldn't be a balanced post without "Always look on the bright side of life"Right.

Who threw that!

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.