- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

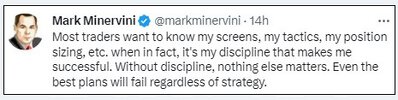

Some members can't stop complaining when they don't agree

Dealing with members who constantly complain & refuse to accept differing perspectives from their own "can be" a significant source of frustration. This is especially true when those members have a fanboy mentality & won't accept any information that challenges their hero. Even when they are presented with compelling evidence, they still fail to see the point.

For balance

It's important to keep in mind that everyone is entitled to their view. To me, it would be more productive to focus on presenting an alternative, rather than taking a stance on "who is right & who is wrong".

Skate.

Dealing with members who constantly complain & refuse to accept differing perspectives from their own "can be" a significant source of frustration. This is especially true when those members have a fanboy mentality & won't accept any information that challenges their hero. Even when they are presented with compelling evidence, they still fail to see the point.

For balance

It's important to keep in mind that everyone is entitled to their view. To me, it would be more productive to focus on presenting an alternative, rather than taking a stance on "who is right & who is wrong".

Skate.