- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Worth reposting in this thread as it's exactly correct. New traders and investors generally abandon winning strategies too early.

valuation calculated from what the underlying physical economy is doing. Inputs like productivity, population, inflation target, profit share to wages vs capital etc. Not specifically cash rate – that is more driven by the underlying economy.

The fact that you would disclose your system screams 'abundance mindset'. My contention is that someone with a scarcity mindset would not be able to trade this same system to the same degree of profitability. This would imply that the mindset is the primary determinant of success.

Thanks Skate.

Translating from English to AFL, I get:

MapBuyCondition = ( Close > MA( Close, 10 AND ROC(C,10)>0) OR (Close == 1.1 * Ref( Close, -1 ) and V>Ref(MA(V,10),-1)) );

@Gringotts Bank, your combined code is spot on.

I have posted the base code for the ‘MapBuyCondition’ as my additional filters, parameters & indicators are listed separately & are merged in the Buy condition.

Question

Do you have the time to backtest & post the results?

Skate.

Lets talk about the 'MAP Strategy'

Is it possible to trade & code a feeling that you believe will make money.

Confidence

We all have opinions of what works & what doesn't when it comes to trading but we always find it difficult to code & have the confidence to trade it.

Coded & tested

My idea coded up well & the strategy backtested with pleasing results. The MAP strategy has only a few conditions when to buy & sell. Most seasoned traders "just know" when a move is on but sometimes lack the correct tools to capture the move OR have the confidence to take the trade - it’s so much easier to go with the trend than fighting against it.

Nothings perfect

All indicators are lagging & they need a period of time to establish a pattern & that’s why trading ‘Moving Averages’ is not an exact science. Getting into & out of a move can be tricky but get it right & the strategy has potential.

The 'MAP Strategy' – is simply one line of code

The Map strategy is built around one line of code with a variety of indicators mentioned in my previous post.

The Map Strategy in English

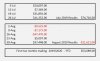

Buy whenever the closing price is higher than a 10 period Moving Average conditional on the ROC filter being above 0% - OR - Buy when the Closing price is at least 10% higher than the previous weeks close with volume higher than the Moving Average period.

The Map Strategy in AmiBroker code

MapBuyCondition = ( Close > MA( Close, 10 ) OR Close == 1.1 * Ref( Close, -1 ) );

Requesting - Weekly timeframe

Most traders who use AmiBroker will have a trading template & I'm asking nicely if a user that has a template to add the one line of code above, backtest it & post the backtest results for others to view.

Validation

Independent Backtesting of the line of code will validate if the idea has legs - OR - not.

Skate.

It's a given - all trend trading strategies perform well in a roaring bull market

Hi @qldfrog My Hybrid Strategy gave a sell signal as well & looking at the chart you can understand why. Rebounding just after you sell it does mess with you only to 'pour salt on the wound' with a signal to buy on the next bar.

Hi Skate,

Have you back tested your system to buy on the close if higher than open?

Just curious as a weekly system why carn't you take the entry any day of the entry bar?

I am aware then you would say need to place order in say last half hour on friday.

I'm not really sure were it is classified as beginners cycle?Hi @willoneau

"need to place order in say last half hour on friday"

When I first started to trade back in 2015 I did exactly that, sell at 3:30 pm on a Friday instead of entering in the pre-auction - sometimes you win but mostly it turned out to be a disadvantage with my style of trading - this is a perfect example of "the beginners cycle"

I'm not really sure were it is classified as beginners cycle?

A weekly system gives you entry triggers, if you don't take some or enter slightly later you should still be within your Monti Carlo range of results. Be it at either the lower or higher end of that distribution.

Will do.@willoneau as you reference Nick Radge from the chartist it would be beneficial to read this pdf extract about the “Beginners Cycle”

https://www.thechartist.com.au/images/Breaking_the_beginners_cycle.pdf

Skate.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.