- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Thanx Skase , I did notice the difference between your losing and closed trades. So your winning and losing trades would actually be position not trade because you haven't actually traded is that right?

Finding the correct medium between winning% profit% and drawdown is what most of us strive for.

My aim is around 50% win rate

30% profit

and under 20% drawdown.

review-

win%= 30%

return on capital= -11.2%

expectancy= -0.51

Hi guys,

I’m new to this forum but I would love some advice, information or some guidance on trading. What I’m looking for is a life coach or mentor to teach me the ropes on how to trade effectively for a long to medium term investment.

Thank you and any support would be appreciated.

Oh for the good old days, I recently rolled over a term deposit 2.3%, when will we return to long term average?

View attachment 95778 Current rates

Very interesting!

I have traded 12 stocks in and out since Feb. I decided to have no trading plan or correct mental attitude but I wanted to see what I would find doing random trading. Four fails, four wins, four break evens-ish, very, very poor result. I decided to just go back to Weinstein+. It works....for me.

Now this month I have begun for real. I have two stocks so far and the other two bits of money are DRPs that got caught when I closed in a hurry through injury a couple of years ago, which I must clean out one day. I am going slow with a maximum of $5000 per trade until I am happy I am getting this right.

View attachment 95773

the highest listed by @Value Collector.

Skate, sorry for my ignorance but I didn't understand the bit from your post which is listed below. Could you please explain a little more.

All clear, thanks for the explanation Skate.Hi @aus_trader, sorry for the confusion the graphic that I referenced came across as a hyperlink ONLY that @Value Collector posted ( View attachment 95778 Current rates )

My Graphic

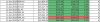

I posted a snippet displaying 27 of my current positions that have exceeded 8% all within the last 6 months of trading. It was a visual representation of what can be achieve from actively rather than passively investing your funds. My current returns posted above range from 8.46% to 104.49%

The highest return quoted in the graphic below is 8.2%. (This is the missing Graphic from my previous post)

View attachment 95786

The Thread: Alternatives to Term Deposit? I was referencing this post: https://www.aussiestockforums.com/posts/1032461/

I was fumbling to say

Since January, I have 27 positions exceeding the return of 8.2%. If you wanted to chase better returns than the 8% I was suggesting actively trading the markets using a system explained in the 'Dump it here' thread.

Trading as with any endeavour that offers good long term returns do carry an added level of risk. I also remarked you can minimise the risk while at the same time magnifying your returns with the right strategy.

Skate.

If this doesn't excite you nothing will!!!

View attachment 95834

Not long now

In recent posts it appears @captain black & @tech/a interest has been reignited confirming both are about to post more about the nitty gritty of trading & for one I can't wait. It's a real shame knowing to gain experience it consumes so much time & effort, it's a real pity we're not able to download experience like we do with most computer programs.

Skate.

Valuable words skate for everyone following a systematic trading plan.

A great quote by @tech/a

Our aim is to identify opportunity --- to anticipate a move in our direction and take advantage of it. if we are right stay right for as long as our analysis anticipates further momentum in our direction all the while mitigating Risk and maximising profit. If Wrong----don't stay Wrong for TOO LONG!.

I posted the charts with buy and sell signals of AQG and SLR in my futures thread last week and the current charts of both are good examples of short term momentum trading.

There was a quote by @peter2 in @Skate 's thread a few weeks ago about trading in thin markets.

For short term trading it's important to have a proactive rather than reactive exit. Reactive exits work well for trend following systems. You take the exit when there is confirmation of a change in trend. If you're short term trading in small caps waiting for confirmation means you end up selling into a very thin depth on the buy side and taking a big hit from the resulting slippage.

Both AQG and SLR show where price has stalled after the exit. If price takes off again strongly then I'll likely get another entry signal.

View attachment 95859

View attachment 95860

It's not my job to think - I've got one JOB to do when it comes to trading & that one job is to follow my system without fail..

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?