- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Trading a Daily System

I don't particularly enjoy trading daily systems, as the 5 minutes per day it requires can be exhausting. However, as @qldfrog has pointed out, there are advantages to quickly actioning signals rather than hoping for a price recovery after a downturn. Over time, I've come to realise it's better to err on the side of caution. Even if I exit a position prematurely, I can always buy back in.

Closing Out of a Position

While it's still early days, I've learned that a signal generator doesn't always mean exiting with a loss. Just as often, the system will signal an exit with a profit. As a natural trend trader, I've had to overcome the urge to ride out trades to maximise gains, as this can lead to relinquishing open profits. That's why I'm now a strong advocate of incorporating "Take Profit" stops into my trading strategies. With a signal generator, you don't need anything fancy - it can sense when a ride is coming to an end, and that pre-warning is invaluable.

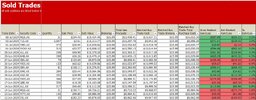

Not Every Exit is a Loser

When reviewing my "Sold Report," I've found that half of the exits are winners, leaving only the open positions still generating profits in the market. This suggests that the signal generator is doing a respectable job of identifying the right times to close out positions, even if not every exit is a winner.

Skate.