- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,351

My first ever book I read was from Alan... My singing sucks but I can dance... Well, I think I can..Since that was the blast from your past; please step up to the podium, grab the mix and start the kareoke show and here is the materials for the kareoke https://alanhull.com/uploads/documents/Active Trading Online Manual.pdf

I will catch up with you once I am done with my thing

This was the bookSince that was the blast from your past; please step up to the podium, grab the mix and start the kareoke show and here is the materials for the kareoke https://alanhull.com/uploads/documents/Active Trading Online Manual.pdf

I will catch up with you once I am done with my thing

I'm very disappointed with my performance this FY. If you can't beat buy and hold why bother?

Professor, as usual powerful words of wisdom.@peter2, I can understand your frustration with your trading performance this financial year. Comparing your trading results to a simple buy-and-hold strategy can be demoralising, especially when the markets have been volatile. However, I would encourage you to not be too hard on yourself.

Trading the ASX this past year has had its fair share of challenges. The markets have been turbulent, with many unexpected twists and turns. The fact that you've been able to keep your head above water is an accomplishment in itself. In a year like this, sometimes "good enough" really is "good enough". That said, I know the temptation to strive for better can be strong, especially when we set high expectations for ourselves.

Skate.

I know we all make mistakes and I realise that mistakes are common

View attachment 178728

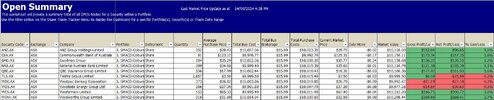

Objective

In this hypothetical investment exercise, we measure the performance of Australia's top 20 listed companies as of the 1st of May 2024. The aim is to explore the year-to-date returns of investing $100,000 ($5,000 in each of the 20 companies) from the 1st of July 2023, considering capital gains and dividends. The ASX20 index will be rebalanced annually to simplify the process. It's important to note that survivorship bias was introduced in the initial analysis. The primary goal is to demonstrate a streamlined approach for newcomers to participate in the markets with ease.

Exercise end date

The final post for this exercise will be presented on Sunday the 30th of June 2024.

View attachment 178730

Skate.

So is this 'strategy' ending on 30 June 2024?

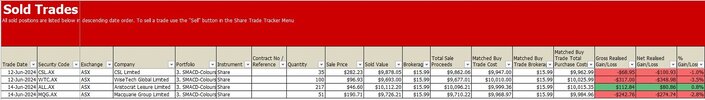

in hindsight, the decision to switch from trading to investing at the end of December was not one of my better moves. During the first half of the financial year, my trading strategy had been performing well, generating a 21.73% increase. However, with just two weeks left in the year, I've now blown through nearly half of those open profits, resulting in a year-to-date return of 9.92%.

@ducati916, I don't have to end the investment strategy exercise on the 30th of June 2024. The original plan was to measure the performance of Australia's top 20 listed companies, considering both capital gains and dividends, over 12 months from the 1st of July 2023 to the 30th of June 2024.

While the year-long evaluation period will be complete at the end of this month, I don't have to end the exercise at this point. The data and insights gathered could still hold value, even if the tracking period is extended.

What are your thoughts on continuing this investment exercise?

Skate.

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?