- Joined

- 28 August 2022

- Posts

- 7,232

- Reactions

- 11,796

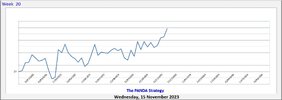

Dave I reckon that your on the money here. Sometimes caution is needed other times charge in like a bull in a china shop and depart just as quickly. The market always dictates the win or loss.@Skate if I can use the analogy of a band, the trend is the lead singer of the band but without the other instruments to provide the music, the song is not always a success. So what I'm trying to say is, long-term or short-term, you still need all the elements together that give you a high probability of success. The difference between short-term and long-term is mainly the time frame, but sometimes a short-term trade can turn into a long-term trade. I'm not sure if this is feedback that you were looking for but I just thought that I'd throw it out there.

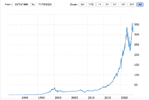

Oh to have that crystal ball that tells all.