- Joined

- 13 February 2006

- Posts

- 5,286

- Reactions

- 12,185

Risk of Ruin is definitely something that new traders should be aware of, I've heard many stories of people that have lost their entire account. There are a number of ways that RofR can be reduced in your trade plan like diversification, balancing your directional exposure and not committing all your funds to the market. Even when your RofR has been reduced by a mix of these methods, it still has not been fully controlled.

The only way I know to fully control your RofR, and when I say 'control it' I mean actually removing your exposure to RofR, is to use options. Options can be used in many complex ways, they are the most flexible trading vehicle that exits and this is a double edged sword causing a lot people to view them as being too complex to make the effort to learn. The reality is that in order to replace the basic functions of buying and selling stock, only a basic options knowledge is required. The additional functionality of being able to go Long or Short and having hard definable stops just comes with the fact that your buying and selling options instead of buying and selling stock.

Correct. Options can control (manage) risk of ruin.

Options come with the necessity to understand and implement the 'greeks'. A quote from Steve Jobs:

Option greeks are complex. They can be made simple. However that is not an easy undertaking.

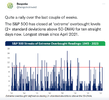

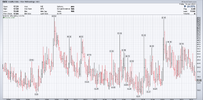

Tail risk (fat) are far more common than Gaussian (Bell curve) statistical analysis allows.

If you are long, obviously this is a positive fat tail. The issue is that if you are 100% long then the left hand side fat tails often hit in excess of 5STD, which should never happen in the life of the universe, yet pop up with alarming regularity.

10 Hedge Fund blow-ups: https://www.valuewalk.com/top-10-hedge-fund-blow-ups/

A primer on SD: https://www.nasdaq.com/articles/how-many-sigmas-was-the-flash-correction-plunge-2020-03-04

List of 1 day moves: https://www.forbes.com/sites/baldwin/2022/11/10/wall-street-goes-crazy-the-numbers/?sh=312f8e27681f

And another study on frequency: https://blogs.cfainstitute.org/investor/2012/08/27/fact-file-sp-500s-sigma-events/

A little out of date:

An issue that I have with mechanical systems is that they engender (potentially) a false sense of security that risk is well managed.

jog on

duc