or Norgate advance-decline?Alternatively, you can just use the ADX

Dump it Here

- Thread starter Skate

- Start date

- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

" I kindly request that you prioritise studying the materials I have provided & conduct your independent research on the timing filter."

Just post the backtest for > 1yr.

Duc,

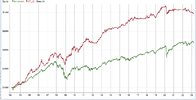

Here's your ADX(14) > 25 theory against the base system. CAGR: +14.49% maxDD: -36.4%.

For those wondering where and why this discussion has started...

Original research on this topic.

Just post the backtest for > 1yr.

Duc,

Here's your ADX(14) > 25 theory against the base system. CAGR: +14.49% maxDD: -36.4%.

For those wondering where and why this discussion has started...

Original research on this topic.

- Joined

- 13 February 2006

- Posts

- 5,387

- Reactions

- 12,516

" I kindly request that you prioritise studying the materials I have provided & conduct your independent research on the timing filter."

Just post the backtest for > 1yr.

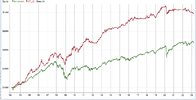

Duc,

Here's your ADX(14) > 25 theory against the base system. CAGR: +14.49% maxDD: -36.4%.

View attachment 155040

For those wondering where and why this discussion has started...

Original research on this topic.

Nick, long time...

So that's actually pretty good, although with that level of drawdown, probably too hard psychologically to actually trade for most. I couldn't endure that level of drawdown.

jog on

duc

- Joined

- 8 June 2008

- Posts

- 13,621

- Reactions

- 20,269

in amibroker: #XAOADR.au for the xaoor Norgate advance-decline?

- Joined

- 8 June 2008

- Posts

- 13,621

- Reactions

- 20,269

Hi @Nick Radge , I would still point that anything more than 10y old is probably actually irrelevant;" I kindly request that you prioritise studying the materials I have provided & conduct your independent research on the timing filter."

Just post the backtest for > 1yr.

Duc,

Here's your ADX(14) > 25 theory against the base system. CAGR: +14.49% maxDD: -36.4%.

View attachment 155040

For those wondering where and why this discussion has started...

Original research on this topic.

while human psyche (grossly) remains unchanged: fear greed;

execution speed and tools as well as information spread has been radically accelerated

So what used to take days takes minutes , and this impacts whatever parameters are used in systems;

unless you have dynamic parameters in your BT;

I understand this is debatable..and has been debated here again and again with people expressing different views ..fair; but for me, any backtest going back further than 2018 is fairy tale in its odds as being valuable,

unless you look at monthly or quarterly time frame maybe...

But comparison can still be made fair.

I still would not like to start a system in mid 2018 and reaching a time today, 5y down the track, where I have lost all my gains, as per above

add inflation and the pain is severe

(edited for typos)

- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

We can't get data past a year, nevertheless back to 2018....

" any backtest going back further than 2018 is fairy tale in its odds as being valuable,"

Good luck with that.

I agree that more recent data is more important and that a strategy should be correctly 'tuned' to more recent data, however, without looking at past events, i.e. 2001 - 2003 bear market, GFC, Sep 11, 2011 tsunami, you are traveling blind

" any backtest going back further than 2018 is fairy tale in its odds as being valuable,"

Good luck with that.

I agree that more recent data is more important and that a strategy should be correctly 'tuned' to more recent data, however, without looking at past events, i.e. 2001 - 2003 bear market, GFC, Sep 11, 2011 tsunami, you are traveling blind

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Just post the backtest for > 1yr.

Apologies

I normally respond as quickly as possible but I've been delayed today by a meeting with a site supervisor.

The first backtest results

As @Nick Radge has requested a backtest greater than one year I'm submitting thIs backtest from the 1st of January 2020. This is a trading period where even the best traders have struggled with profitability.

but for me, any backtest going back further than 2018 is fairy tale in its odds as being valuable,

The second backtest results

This backtest is over a longer period from the 1st of 2018 to now a backtest period that @qldfrog would find value with.

Clarification

The backtest results demonstrate that incorporating the 'PercentageUp Filter' as shown on the right significantly improves the performance & profitability of the strategy which isn't too shabby.

Backtest period (1st January 2020 to now)

"The backtest results below compare the performance of the same trading strategy using two different filters: a 10-period Index Filter on the left & a 'PercentageUp Filter' on the right. The 10-period Index Filter is a traditional filter that looks at the moving average of prices over a set time period, while the 'PercentageUp Filter' calculates the percentage increase in a data point over a set time period.

" any backtest going back further than 2018 is fairy tale in its odds as being valuable,"

Backtest period (1st January 2018 to now)

"The backtest results below compare the performance of the same trading strategy using two different filters: a 10-period Index Filter on the left backtest & a corresponding backtest incorporating my 'PercentageUp Filter' that's on the right.

In summary

The 'PercentageUp Filter' produces results. Specifically, the 'PercentageUp Filter' produced a higher overall return. Overall these results demonstrate the value of using the "PercentageUp Filter" in trading strategies & highlight the potential benefits of incorporating new & innovative timing filters into traditional trading strategies. I also must stress that backtesting is just one tool for evaluating a trading strategy, & it should not be relied upon as the sole indicator of future performance.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

I would still point that anything more than 10y old is probably actually irrelevant;

while human psyche (grossly) remains unchanged: fear greed;

execution speed and tools as well as information spread has been radically accelerated

Determining the optimal backtest period

Determining the optimal backtest period for a trading strategy is a complex task. It is not possible to rely on a single backtest period that will suit every strategy & trader. The ideal length of a backtest period varies based on various factors such as the trading strategy, market conditions, & data frequency.

In general

A backtest period should be long enough to cover a range of market conditions & short enough to avoid using irrelevant or outdated data. Typically, a backtest period of 5-10 years is considered reasonable for most trading strategies. However, as pointed out by some, certain short-term strategies may require a shorter backtest period of 1-2 years.

A backtest allows you to evaluate a strategy

It's essential to keep in mind that the backtest period alone is not sufficient to evaluate the performance of a trading strategy. Furthermore, validating the results of the backtest by forward-testing the strategy in a live market environment is critical to assess the strategy's performance accurately. By doing so, a trader can ensure that the strategy performs well in real-time market conditions & not just in historical data.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

So that's actually pretty good, although with that level of drawdown, probably too hard psychologically to actually trade for most. I couldn't endure that level of drawdown.

Drawdowns are a large consideration when developing a strategy

@ducati916 has raised a crucial topic that is often overlooked in trading, the importance of developing a trading strategy that matches one's risk tolerance & psychological comfort level. High levels of drawdown can be emotionally challenging for many traders & can have a significant impact on their mental & emotional well-being. Therefore, controlling drawdown is an essential consideration when developing any trading strategy, well it is for me. I pride myself on developing strategies with a low drawdown, a drawdown level that I can handle.

Backtesting is only a tool

While backtesting is a valuable tool for evaluating a trading strategy's potential performance, it is equally important to consider personal risk tolerance & the psychological impact of drawdowns before implementing any strategy in real trading. Traders should take a well-informed & measured approach to trading & only trade strategies that align with their individual financial goals & emotional well-being.

To summarise, emotions drive the markets

it's crucial to control drawdowns when developing a trading strategy to ensure that the strategy matches one's risk tolerance & emotional comfort level. Trading strategies should be evaluated based on individual financial goals & emotional well-being, & traders should take a well-informed & measured approach to trading.

Skate.

Last edited:

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

There are some brave souls who are "proud of their ability" to suffer great monetary pains while they wait for their convictions to be rewarded.

Another important topic

Profiting from the stock market consistently over a long period of time is exceedingly difficult due to the irrational nature of the market & the emotions of its participants. The markets are constantly evolving, & major events can cause significant market movements that are often unpredictable.

One of the keys to successful trading is knowing when to exit a trade

In fact, a smart exit can often be more important than a smart entry. Traders who are willing to cut their losses & move on when things aren't going well are often more successful than those who "stubbornly" hold onto a losing position in the hopes that it will turn around.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

In trading as well as "any" personal endevours

It's essential to respond rather than react to any situation, as responding gives you time to think. When things don't feel right, it's crucial to take a step back & assess the situation before making any decisions. This breathing space can help traders to evaluate market conditions & make better-informed decisions.

In summary

Profiting from the stock market consistently over the long term is a challenging task. Successful traders understand the importance of a smart exit strategy & know when to cut their losses. They also respond to market conditions rather than reacting impulsively & take the necessary time to evaluate the situation before making any decisions.

I've had my say

It's about time I should hop down off my soapbox before wearing out my welcome.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Faulty thinking has no place in trading

In trading, faulty thinking can lead to poor decision-making & financial losses. To avoid this, we must use our capacity to reason & think critically to solve problems & constantly pursue new trading ideas. By doing so, we can make progress & improve our trading skills.

Technology only gets you so far

In today's world, where technology has made many tasks easier & more efficient, it's easy to forget the significance of our intellectual abilities. However, our ability to think & reason is what makes us different from most. Thinking is crucial to our personal development & trading education. It's important to recognise the value of critical thinking & use our minds to their fullest potential in trading & in life.

Problem-solving & new ideas

Our capacity to reason & think critically enables us to solve trading problems & create new ideas that can help us achieve more than we thought possible in our personal development & trading education. By emphasizing the importance of critical thinking, we can ensure that we're making sound decisions based on reason & logic, rather than simply relying on intuition or emotion.

Skate.

In trading, faulty thinking can lead to poor decision-making & financial losses. To avoid this, we must use our capacity to reason & think critically to solve problems & constantly pursue new trading ideas. By doing so, we can make progress & improve our trading skills.

Technology only gets you so far

In today's world, where technology has made many tasks easier & more efficient, it's easy to forget the significance of our intellectual abilities. However, our ability to think & reason is what makes us different from most. Thinking is crucial to our personal development & trading education. It's important to recognise the value of critical thinking & use our minds to their fullest potential in trading & in life.

Problem-solving & new ideas

Our capacity to reason & think critically enables us to solve trading problems & create new ideas that can help us achieve more than we thought possible in our personal development & trading education. By emphasizing the importance of critical thinking, we can ensure that we're making sound decisions based on reason & logic, rather than simply relying on intuition or emotion.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Good morningFaulty thinking has no place in trading

In trading, faulty thinking can lead to poor decision-making & financial losses. To avoid this, we must use our capacity to reason & think critically to solve problems & constantly pursue new trading ideas. By doing so, we can make progress & improve our trading skills.

Technology only gets you so far

In today's world, where technology has made many tasks easier & more efficient, it's easy to forget the significance of our intellectual abilities. However, our ability to think & reason is what makes us different from most. Thinking is crucial to our personal development & trading education. It's important to recognise the value of critical thinking & use our minds to their fullest potential in trading & in life.

Problem-solving & new ideas

Our capacity to reason & think critically enables us to solve trading problems & create new ideas that can help us achieve more than we thought possible in our personal development & trading education. By emphasizing the importance of critical thinking, we can ensure that we're making sound decisions based on reason & logic, rather than simply relying on intuition or emotion.

Skate.

A trader needs to be honest with oneself at all times. If you do not possess integrity, you will fail, at some stage of your trading life as your judgement will be compromised and one day that will be exposed.

Have a very nice weekend.

Kind regards

rcw1

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

A trader needs to be honest with oneself at all times. If you do not possess integrity, you will fail, at some stage of your trading life as your judgement will be compromised and one day that will be exposed

Quotes can be powerful

@rcw1 you are absolutely correct in making those assertions. Quotes reinforce important ideas or concepts in just a few words. They can distill complex thoughts or emotions into a simple, memorable phrase that can be easily recalled & repeated. Different quotes will resonate more with different people, depending on their personal experiences & perspectives. However, even if a quote doesn't immediately resonate with someone, it can still be valuable as a reminder of a particular idea or as a source of inspiration.

Skate.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Overall, quotes can be a powerful tool for reinforcing important ideas

As they have the ability to inspire us to take action & help us stay focused on our goals & values.

For example

A quote like "In the middle of every difficulty lies opportunity" (Albert Einstein) can remind us to look for the positive in challenging situations & to approach problems with a solution-oriented mindset.

Another quote

Like "You are never too old to set another goal or to dream a new dream" (C.S. Lewis) can inspire us to continue pursuing our passions & aspirations when trading, regardless of our age or circumstances.

Skate.

As they have the ability to inspire us to take action & help us stay focused on our goals & values.

For example

A quote like "In the middle of every difficulty lies opportunity" (Albert Einstein) can remind us to look for the positive in challenging situations & to approach problems with a solution-oriented mindset.

Another quote

Like "You are never too old to set another goal or to dream a new dream" (C.S. Lewis) can inspire us to continue pursuing our passions & aspirations when trading, regardless of our age or circumstances.

Skate.

- Joined

- 13 February 2006

- Posts

- 5,387

- Reactions

- 12,516

@rcw1 quoted this back in December

It's well worth a second post as it ties into my series of posts today.

View attachment 155218

Skate.

So we have another quote:

"You can never go broke taking a profit."

An example of faulty thinking or maybe more fairly without fully considering the second derivatives of that statement.

jog on

duc

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Which reminds me of this nugget - worth listening to for at least the next 3 minutes from this point - part of a BST interview with Lawrence Chan:

We are all too time-poor, that's our excuse

"We often use being too busy as an excuse, but in reality, it may just be that we don't feel like making the effort. However, when members of this forum share their trading knowledge & experience, they are providing valuable information to others."

Being busy is a legitimate challenge that many people face

But we also need to recognise that sometimes we may use it as an excuse when we don't want to put in the effort. Additionally, it highlights the value of sharing knowledge & experience in this forum & encourages readers to take advantage of the insights provided by others.

On such insight, one that I couldn't explain better

@Newt explained in a previous post that you should "except there are periods where you should duck for cover, & conversely there will be somewhat unpredictable bullish trending periods when trend trading will work best. Those are the periods you optimise your trend conditions to detect. Likewise, try and ensure you have robust methods to pick the bad times" going on to recommend a video to watch.

A video from Better System Trader to watch (if you aren't too time-poor)

“How to leverage market biases to improve strategy performance” where Lawrence Chan discusses market bias & how to leverage structural bias to increase strategy performance, including:

• "Atomic strategies" and knowing when to NOT trade,

• The most toxic period to backtest a strategy,

• Why market behaviours are becoming so predictable,

• How some trading platforms are taking traders down the wrong path,

• Exploring biases caused by recurring events,

• Why traders should think in concepts first,

• Plus, leverage & volatility breakouts, chart patterns, simple tools, knowing the behaviours of market participants, the human psyche, market internals & much more.

Watch it here

You'll be wiser for it, that I can guarantee.

Skate.

Similar threads

- Poll

- Replies

- 258

- Views

- 22K