- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

....and also curve fitting (so many system traders have "re-fitted" their index filters this year ??).

Skate, what MA period are you using now for your index filter?

@Trendnomics, I have a buy filter.

Why do some traders do better than others?

I've often said whilst watching sports "that's got to be a fluke" but they seem to fluke it 100% of the time. I believe some traders are better than others & I don't believe there is enough thinking "about" why they are.

I've put my trading success down to the strategies I trade

I find using metrics as part of my "buy condition" to be beneficial. Over the years I've made my share of indicators. Those indicators may not be perfect but they tend to fluke the results that I'm after more times than they don't.

My "Percentage Position Up" indicator & my "Ulcer Up" indicator

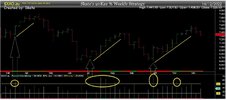

Both these indicators go a long way in helping me achieve profitability. My "Percentage Up Indicator" & the relationship it creates is shown on the chart below.

The "Percentage Indicator"

When the "percentage indicator" is above 50% there is a corresponding rise in the ASX All Ordinaries Index. Restricting the "buy condition" to only when the "Percentage Up Indicator" is above 50% helps avoid the nasties created by using an "Index Filter" in isolation. (which, by-the-way IMHO is better than none)

I believe there is a correlation

The "Percentage Up Index Filter" above 50% & the All Ordinaries pops at the same time. I don't believe this is a "fluke" or an "illusion" but a defined "correlation". Restricting trading during these periods (above 50%) gives you a fighting chance of profitably, which is basically "the name of the game".

Have a read here

@peter2 gave a practical example of why my "Buy Filter" is effective.

Dump it Here

I added the following line Allocation: S.StartEquity this basically means only calculate position size based on the initial equity. So in this case it is 10% of $100,000 for every new position. Like I said these things are so easy in real test. It is actually interesting how much of the edge...

www.aussiestockforums.com

www.aussiestockforums.com

Skate.