- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,350

Good afternoon Skate,

Hoping find you well. Been meaning to touch base much sooner regarding your posts re: Volume-Weighted Moving Average' (VWMA) and other matters. Also, had a chance to go through this thread, nearly 4 years of posts, some marvelous stuff documented, a credit to yourself and those that have contributed along the way. Awfully difficult to keep people happy all the time, as everybody has an opinion on things. It is the nature of our business. Yes, and a good thing too.

The concept of VWMA has been adopted as a trading benchmark embraced by rcw1 for many years. rcw1 applies this concept too swing and day trading methodologies, arduous, but yet rewarding in so many ways. rcw1, for mine, is a swing trader that likes to fast trade, daily and does not use any software other than charting and trading platform. 3 screens and a computer, for old times sake... Have built highways and over passes around /through VWMA so that it is more efficiently executed within scope of personal methodologies. rcw1 broadly defines this process/system as, 'numbers'. It goes well beyond the formula of VWMA. It's all about what is happening real time with depth of the stock and its volume at any point in time. Knowing the why's !! ... Demand v Supply, essentially. Contemporary times of 'computer invasion' of stocks, large shorting issues and super funds grabbing sh-t loads of shares, let alone the world economies and the Dow, makes things most interesting indeed, for the trader, the 'mosquitos' of the market. rcw1 will only target a handful of stocks at any one time so that maximum attention can be drawn in real time as to what they are doing... and trade accordingly.

When the price is above an open, it is up, conversely, when the price is below an open, it is down. No hidden agendas or rocket science here. But these are the start points. This is when the game starts and ends each day. Traders, mostly, look for reversals but can be impatient and 'trigger happy' thus buying when they shouldn't and holding / selling ultimately for a loss. Traders must limit this risk; it is a given. Again, no rocket science here. Traders also need to drink plenty of concrete to toughen up, to do battle again, after a few rounds in the 'trading ring'

Charts obviously play a major role, there are many available, an incredibly valuable resource/tool given the right circumstances. Charts are an excellent indicator, nothing more or for that matter nothing less. A chart cannot guarantee to the trader the stock will go up or go down, it simply provides data in a format for the eyes to easily read and interpret by the brain. Patterns and behaviours present, past and future ... perhaps. All traders will watch carefully for telltale triggers/signals, a mere slight trace of reversal could be enough.

Interestingly, may well pick up perceived different signals watching conjointly a one-minute chart and a 5-minute chart of the same stock movement. ha ha ha ha does one's head in... Also perceived different signals watching the live feed of sales of any particular stock as opposed to chart interpretation. There could well be a block of traders jump in at once, or out ... Who knows unless your on line watching. Then the questions are why?? What for?

rcw1 primary chart is the one-minute chart.

Other evidence-based concepts include, ADR equivalent analysis, TA, research of publications which may reveal valuable information to help make / forecast trading decisions and comments made within chat / community forums.

rcw1 at times performs his own 'numbers' calculations manually, particularly with the first 3 minutes of the trading day (happy to explain this better another time) and maintain 'numbers' records, on a case-by-case basis. As data comes in, it gets added and divided by total volume to that specific point in time in line with the 'numbers' formula. Benchmarking, but not always, time may well not allow to jump in or out, but aligned towards two trades a day, per stock, one off the low of the day and one off the high of the day. What will be the low and what will be the high??? Whatever the trader wants it to be, but it must support and be directly aimed at an earn transaction, profit. Trade what is before you, off the pitch. Could be any number of trades for any one stock, could be none too. Depends.

This is nothing new or for that matter original.

Traders often fail not knowing for sure where price is going; enter when it's not valid for fear of missing out (herd / sheep mentality); over size for the size of the a/c; get greedy and try for more profit outside trading scope. A profit is a profit. rcw1 considers only an accumulative effect of earn both with the sell transaction and then the earn compounded with other trades by the leap frogging immediately into other trading stocks with profit and capital, round and round and round we go.

rcw1 does not abide by rigid rules, as for mine, it can restrict one's own natural ability, however, want to be clear, that rules are in place to mitigate against risk. Rules are good. On the balance rcw1 is a big supporter an advocate of one's own natural ability and being able to work unimpeded or without undue restriction of trading process. Somewhat contradictory I know. The use of your own cultural traits, emotion and application of life's learnings, 'tricks of the trade' are for mine most important. They cannot be taught; they are acquired whilst 'on the tools' where loss and sorrow and 'bloodshed' have been experienced. Experiences, occurrences which all 'value add' towards decision making considerations of when to move on a stock or not!!

During the passage of time rcw1 has become more flexible in the methodologies applied, with emphasis on 'gut feeling' ; déjà vu; making some plays with the numbers presented. Sometimes there is a fine line between utter stupidity and a balanced patient approach to earn. Difficult to define, provide an evidence base for, but nevertheless, rcw1 will rely upon past experiences to trade.

For mine it takes decades to make for a complete trader and even still, there are gaps.

When things don't go well, rcw1 will change trading account, over to a separate and completely different account. 95% of the time is it borrowed cash (Trading Loan) which is used but when trades are not going well, will change over to savings account. Found that this quietened the enthusiasm... a new lease of life so to speak, like a 'smoko break', stemmies the tide... Marvelous how a simple thing like changing an account, steady's the ship.

Perfection is not when you have nothing more to add, but when you have nothing more to take away - Antoine De Saint Exupery.

Perfection requires 'absolute resolve and discipline' in real time. For mine, simplicity in a practical sense helps generate perfection. Perfection cannot be judged over a snapshot of time, it is infinite, it is required to be ongoing, open ended, as applied to the task at hand, in this case, trading. Perfection is a 'state of mind' what rcw1 strives to achieve and remain in 'that zone', when trading. To be perfect. Laugh you may, but that is rcw1 objective every single day that a trade takes place. Once gaining the requisite level of perfection, standard, confidence builds, it snowballs, the mind becomes overwhelmingly full of positive thoughts, clearer mind, clearer picture an enhancement of judgement duly follows.

Setbacks come and go all the time. Landslide setbacks, but traders need to pick oneself off the floor dust oneself off and get back onto the saddle, smarter and wiser, building on the other remarkable traders' trait, that of resilience. True traders run the market over decades. To survive, is a privilege.

rcw1 opinions. There is no script.

Be perfect and trade whatever system the trader is comfortable with. Together in the sandpit to earn, there can be no other motivation.

Have a very nice day, today.

edit: change to read good afternoon

Kind regards

rcw1

@rcw1 your post is pure gold.

Been meaning to touch base much sooner regarding your posts re: Volume-Weighted Moving Average' (VWMA) and other matters.

The open challenge @Captain_Chaza put out was intended to see if you can profit from the markets using just technicals rather than the fundamentals of a company. @Gringotts Bank explained it perfectly when it was insinuated that it's "herd trading" which is 100% correct. System trading is not for everyone but it has been very profitable for me over the years. From my point of view, I've tried to explain how I trade, a trading system that is repeatable.

The concept of VWMA has been adopted as a trading benchmark embraced by rcw1 for many years. rcw1 applies this concept too swing and day trading methodologies, arduous, but yet rewarding in so many ways.

Reporting on the "VWMA Strategy"

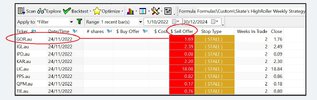

When challenged to trade live with all signals in advance I used the "HighRoller Strategy" as it was the first in the charts. I won't be displaying signals for the other two strategies (1) "The Pirate Strategy" & (2) "The VWMA Strategy" but I will include those ongoing results as part of the Equity Curve for the "HighRoller Strategy" being on the same chart. Leaving the two strategies as part of the "Equity Curve" might encourage others to look for information that we already know.

Possibly there is a fundamental misunderstanding with regard to Mr Skate's trading style.

Mr Skate is a 'Swing Trader', which is 1 step up from a 'day trader'.

Entries are CRITICALLY important as evidenced from the highlighted text. The exits are CRITICAL, which are simply the loss of the entry conditions. The bit in the middle is the expansion of volatility. When volatility expands, things move.

Well who knows

I'm not going to argue with the Duc's assessment of my trading style as I'm smarter than that. I regard myself as a "Mechanical Weekly Trend Trader" who concentrates on getting into confirmed trend & flee like a wimp at the first sign things are not panning out as expected.

Skate.