- Joined

- 28 December 2013

- Posts

- 6,401

- Reactions

- 24,351

It's hard to keep up with the markets

There has been some interesting banter in "the-official-asx-is-tanking-panic-thread" that goes to the very heart of trading. We all speak of bear & bull markets but rarely can pinpoint them accurately in the heat of trading. There are some experienced fundamental traders who tend to have the ability to discern the information accurately. Their conviction speaks volumes. Then there are those who use mathematics to calculate the market pivots using those to decide when to enter & exit a position, a combination of learned experience & gut feelings. Then there are system traders relying on pure mathematics.

Skate.

You're talking another GFC.When bull markets, bear markets are discussed in context of fundamentals, what should be discussed are the big macro ideas and situation. This can largely be done quickly in a chart based format. These macros tend to move slowly, thereby (generally) providing plenty of time to prepare. The issue is more about being early than late.

One of the above is of course the Central Banks. Central Banks are political. Their monetary policies lead the political agenda of the current regime.

Markets will often adjust before Central Banks adjust monetary policy, particularly very large players who require lots of liquidity to enter/exit. Their footprints are seen in advance/decline charts.

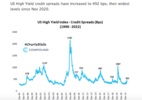

The Bond market will usually lead stocks, starting with long duration end of the curve. Yield curves are important information as are credit spreads.

View attachment 142284

The issue with credit spreads is that it signals a contraction of liquidity. Markets of today, more than yesteryear are 'X' times more susceptible to contracting liquidity. This is because the derivatives markets are so much larger. The current derivatives market is $1.4Quadrillion in size. Of that number close to 60% are SWAPS. SWAPS are private market, unregulated, blind, contracts that settle in CASH. Given that the base money supply M2 is a fraction of the derivative market, never mind the cash requirements of everything else, and you can see it doesn't take much for a credit crunch to morph into a liquidity event.

View attachment 142287

Currently the commercial banks are seeking to earn a pittance on overnight loans to the Fed. That is now $2T/night. Banks are holding or hoarding cash. Why? Because as the Fed shrinks its Balance Sheet, cash will become the only thing that protects them from a liquidity event...and the Fed steps back in. Or not, think LEH.

Another way of looking at liquidity is demand for the dollar:

View attachment 142288

This bear for stocks only changes when the Fed capitulates and adds back (huge) liquidity. The issue then becomes a dollar survival issue.

The point being: to call big stock market conditions (bull/bear) requires looking not only at the stock market. Currencies, interest rates (credit spreads) commodities (inflation) and bond markets are all necessary inputs.

Then look at the major segments of the market. Financials are a good one. You can never have a bull market unless the financials come to the party. Also, conversely, when the financials (banks etc) are weak, the market is weak.

View attachment 142289

The writing was on the wall at the start of the year. This next chart echoes what @peter2 and @Skate have been saying about relative strength, just on a macro level:

View attachment 142290

You can also look at discretionary v staples.

Currently we have another bear market rally. It will fail by the end of next week.

Why?

Because the Fed is still hawkish in their rhetoric. Until that changes, markets remain in bear mode as the Fed reduces liquidity. When they trigger the liquidity event and markets shed another 40%+, they will (late again) try to salvage the crisis. They are a 1 trick pony. Flood the markets with liquidity. That has been their only policy response since Greenspan in 1987.

jog on

duc

The "Platinum Strategy" incorporates an "Index Buy Filter"

When the Index Filter is off it prohibits new signals from being generated keeping you out of the markets when trading conditions are unfavorable. As the "Index Filter" is still off, there are no signals generated this week.

Mr @Skate, I assume that Platinum has no Buy/Sell this week...or did I miss the post?

apologies, I fully missed it...Sorry @qldfrog for the confusion.

I try not to make comments when posting the weekly results but made this comment on the post that has been missed.

Correct, the Platinum Strategy has no "buy or Sell" signals this week.

Skate.

apologies, I fully missed it...

My heresy is published under https://www.aussiestockforums.com/threads/qldfrog-weekly-skate-inspired-system.34570/post-1178053

The other way to see this is that losses trigger you to act.The issue as I see it

When trading is not going our way we tend to look for solutions when really they are not required or there really aren't any. At times for a variety of reasons, the market shift on fear & catches the best laid mathematical formulas wanting.

System Trading works some of the time

It's a simple process, as we are constantly on the lookout for breakouts of repeatable (mathematical) patterns. Then when the ride fails or the momentum slows we try to jump off before the rush. Sometimes it works, sometimes times it doesn't, but that's trading. I'm not immune to losses but over the long run, the market has been very kind to me. I'll keep doing what I have been doing. (Trading multiple strategies helps smooth out my equity curve).

Skate.

I wrote 20y, probably more 40y with a 1980ish startThe other way to see this is that losses trigger you to act.

If trends are shorter in a permabear market with market mini bull in an overall bear fall, it is obvious strategies designed during a 20 y permabull will fail.

If this perma bull is over due to demographics and geopolitics, we have to think outside the box.

I have no crystal ball, maybe our debt based western economie and the Reset will work and keep us moving forward for decades keeping the west ahead. But i have no clues and definitively no certitude.

A short feed back loop based system should/could be the holy grail

The first step is to find the strongest sector in the index, then find the strongest sub-sector within the strongest sector. The final step is to find the strongest stock or stocks to invest in within this sub-sector.

The "Relative Strength Line" (RSL) is a simple mathematical formula to create a "line in the sand" as part of a buy condition. It's a simple relationship to an index.

Even as an index binary filter, this is a worthwhile though indeed or even a small cap index if your system is biased that way..Would you have to use an Equally Weighted Index as base line? Because in a Capital Weighted Index, the bigger stocks that pushes and pulls the Index would a have smaller “Relative Strength” compared to that of a smaller stock (a bias perhaps, maybe).

This is why I hate using the All Ord's as a broad index filter--it really is just a proxy for the ASX20. A weighted index would be very interestingWould you have to use an Equally Weighted Index as base line? Because in a Capital Weighted Index, the bigger stocks that pushes and pulls the Index would a have smaller “Relative Strength” compared to that of a smaller stock (a bias perhaps, maybe).

This is why I hate using the All Ord's as a broad index filter--it really is just a proxy for the ASX20. A weighted index would be very interesting

Not so sure I agree with that.The index you elect to use doesn't really matter in the scheme of things.

Good to know,The index you elect to use doesn't really matter in the scheme of things.

I promise i won't dump anymore stuff here. Apologies for the mess.

I should have said, whatever market or index you are trading "use that market or index" to give you a clue about what the market is doing.

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?