MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

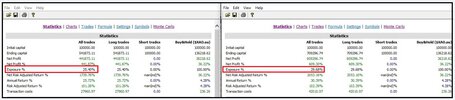

@MovingAverage, this backtest looks uglier but more realistic & there is much to work with. The results since COVID looks okay to me.

View attachment 142070

Skate.

Ok, can see why you assumed that but definitely not the case--both are using the same index filter.

Main difference is the new system on the right is using a more aggressive entry setup. Current system on the left is using an entry confirmation but the system on the right is not using the entry confirmation. This is also show by the fact the right system is taking more trades because it is not looking for an entry confirmation signal.

No way I would ever trade that. The post covid rise you identify is an anomaly--how often does a market crash and rebound to that extend. You'd effective be trading year after year hoping from a rapid sell off in the hope of a massive rebound. Nope--not for me I'm afraid.

You're talking about the increase in exposure, right? It's taking more trades which drives up the exposure.

Agree...there is no absolute right system...you trade what suits your personal style and what your objectives are. For me I like consistent yearly returns and happy to trade off headline performance to get consistency--there's no free lunch. Highlighting this was the point of my post.@MovingAverage, if presented with those three strategies to improve I would ask for the last one. As @qldfrog said, "People are different".

Traders, we are all different

While one person sees an opportunity, others see something completely different. Thus, it’s our perception that creates value at any given time.

Skate.

Sorry, I should have framed the question differently to avoid confusion.

My question

Why is the exposure of both systems so low?

View attachment 142074

Skate.

Agree...there is no absolute right system...you trade what suits your personal style and what your objectives are. For me I like consistent yearly returns and happy to trade off headline performance to get consistency--there's no free lunch. Highlighting this was the point of my post.

I should add that more importantly the short hold times reduced significantly the standard deviation in returns during MC analysis. For me this is important since it improves OOS returns lining up with sims, which is again back to predictability of future performance.Ok sorry--got it.

It is not an overly aggressive system as you can tell. In summary--the answer to your question is look at the average hold time...it has a conservative entry set up and when it does take a position it generally only holds the position for a relatively short period of time. I deliberately wanted this system to have short hold times so I could reduce drawdown.

The extra trades was also a factor in me sticking to the original version of the system. Interesting the number of trades jumped significantly but the exposure didn't jump as significantly. For me personally I often view the number of trades as a measure of a system's efficiency--the more trades the less efficient.What a great exercise, for everyone to see 2 experienced traders looking through the glasses of very different experiences and preferences. Thanks for sharing MA. I wasn't convinced there was a statistical difference in the 2 systems until saw how many more trades the 2nd system would take. Not my style to take too many extra trades without significant improvement in returns, so I'd be sticking with System 1 probably....

For sure...if it was easy everyone would be making money, but reality is someone has to lose money for someone to make money and if it was easy no one would lose money."You win some & you lose some"

If trading was easy, we wouldn't need this forum.

Skate.

Although @Skate some say that the market may not be a zero sum game.For sure...if it was easy everyone would be making money, but reality is someone has to lose money for someone to make money and if it was easy no one would lose money.

YupYou stats show for the original system winners are held for 15.67 bars for 21.93%. But the version with no market filter holds for 170.22 bars for 79%? Seems to be a big reliance on the index filter.

Don't understand what you mean? My index filter doesn't do any tradesHow many 'trades' did your index filter do in the test period?

You understand that this is very debatable, I would disagree there and efficiency is based on cost, at the extreme, if it costs nothing to trade a lot, do it if the returns or risk justify it.the more trades the less efficient.

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?