- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Now we know what the US has for us on Monday ?Big downers on a Fri never much fun waiting to see what the US market serves up for our Monday.....

Good lord. Split Enz are back!Now we know what the US has for us on Monday ?

I just wish the US Fed would get on with it and rip that bloody Band-Aid off—just hurry up and put up interest rates so we can all get on with life. All this “will they won’t they” is just creating uncertainty.Big downers on a Fri never much fun waiting to see what the US market serves up for our Monday.....

AgreeI just wish the US Fed would get on with it and rip that bloody Band-Aid off—just hurry up and put up interest rates so we can all get on with life. All this “will they won’t they” is just creating uncertainty.

Nope. Swing system getting busy and 75% invested with a bunch of buys for Thursday, daily EOD closing out a bunch of positions on Thu and will remain about 20% invested and my weekly still 50% invest but that may well change come Friday.A bit quiet in here. Hopefully everyone’s systems has reverted them to cash during this decline.

some but not all, so a 5 figure loss today on my systems currently 60% cash and one bear position.all daily are good but weekly obviously feeling the hit/heatA bit quiet in here. Hopefully everyone’s systems has reverted them to cash during this decline.

Tomorrow will certainly be a welcome breather, but still 2 days of upcoming action in the US to deal with on ThursdayTomorrow will be a good day

My motto is, any day you don't lose is a "good day". I'm expecting a "good day" tomorrow as I only trade the ASX.

A bit quiet in here. Hopefully everyone’s systems has reverted them to cash during this decline.

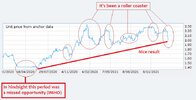

What you're looking at below is the unit value of my weekly system. You can clearly see this week's drawdown, but as can be easily seen the system has had worse post covid drawdowns (look at late Jan / early Feb 2021) but while the portfolio's value has experienced considerable volatility since Nov of 2020 it has continued to move upwards.The Edge

@MovingAverage & many more has the most basic thing you need to be a successful trader is an edge, an advantage in your trading that produces a positive net profit over the long-term. This edge is the culmination of all your research, planning, execution, & state of mind while managing your portfolio. When you want to make money over the long run, a good way to analyse a strategy is to look at the history of its returns. The time period that you do this is a contentious issue in this thread. Survivorship is the name of this game.

Skate.

What you're looking at below is the unit value of my weekly system. You can clearly see this week's drawdown, but as can be easily seen the system has had worse post covid drawdowns (look at late Jan / early Feb 2021) but while the portfolio's value has experienced considerable volatility since Nov of 2020 it has continued to move upwards.

View attachment 136522

And this FY was great for MA; but in a week like this week, unless trading shorts, you can at best limit losses/be 100% in cash.What you're looking at below is the unit value of my weekly system. You can clearly see this week's drawdown, but as can be easily seen the system has had worse post covid drawdowns (look at late Jan / early Feb 2021) but while the portfolio's value has experienced considerable volatility since Nov of 2020 it has continued to move upwards.

View attachment 136522

I should add that this week's sell off has seen my system go into a drawdown of about 10%--well with the system's simulated max drawdown of around 20%.What you're looking at below is the unit value of my weekly system. You can clearly see this week's drawdown, but as can be easily seen the system has had worse post covid drawdowns (look at late Jan / early Feb 2021) but while the portfolio's value has experienced considerable volatility since Nov of 2020 it has continued to move upwards.

View attachment 136522

Conviction

This is what I'm talking about "having the correct mindset" to trade with conviction. Well done.

View attachment 136527

Skate.

"Conviction" is absolutely what it is all about. I hear you on the missed opportunity but my system was 100% cash at that stage because the index system had the system turned off.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.