MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

Yes, those that base their decision to go live following a few optimisations and a single run backtest I would definitely say you’re correct.What becomes very clear, quite quickly, is that many systems traders do not have and/or do not understand what is an 'edge'.

jog on

duc

Maybe question of quality? Your first choice of 12 having stronger potential than your last 8 making up the numbers?So why would my systems perf be significantly and consistently better with let's say a max of 12 vs 20 positions.

Note: Some of these systems have a max number of new positions per bar

Looking forward to your views there

true and if position score is right, this is expected but very quickly these worse choices would be exited and replaced by better entries?Maybe question of quality? Your first choice of 12 having stronger potential than your last 8 making up the numbers?

May i start a subject:

We have talked here and else where a lot about the number of positions in a system. I usually target 20 or so for risk management purpose. Obviously, the more positions, the nearer to the index we are but 20 positions in the XAO universe is not really index matching either. So why would my systems perf be significantly and consistently better with let's say a max of 12 vs 20 positions. Looking forward to your views there

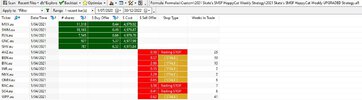

I've been inspired by @Skate's generous contributions regarding some details of his ASX weekly hybrid system. I've been particularly intrigued by the number of open positions in his portfolios (40 - 53). That's a big number to manage and is normally too many for an active trader to manage effectively. I'm comfortable managing portfolios with 8 - 12 ASX positions and position size accordingly. Along comes Skate with his 40 position portfolio and what do I think about managing a 40 - 50 position portfolio as a research project?

Very interesting.

One thing I noticed doing the 40 position portfolio was the abundance of opportunities. I tend to trade the same type of companies every year and trading the 40 position portfolio for six months showed me that I should be trading many more outside my favourites.

A portfolio of 40 positions reduces the influence of luck while the active management ensures the profitable edge and significant out performance against a benchmark in all market conditions. The reason I'm managing a 40 pos portfolio in this thread is to monitor the portfolio heat and see if I can consistently apply an active management style to a portfolio with a large number of positions. It appears from skate's comments that there are approx 6 buy/sells each week once a portfolio is established (more getting a portfolio started). Every one of us can handle that. So the main query is, will the extra effort (increased activity, slightly larger portfolio heat) consistently beat the benchmark and my own 8-12 position portfolios in all market conditions? I won't know unless I model it.

I saw @Skate's results in both bull and bear markets I assumed a 40 position portfolio would match the returns of the index. All the large position size portfolios that I've seen managed in real time struggle to beat the performance of their benchmarks.

Did you adjust your trade size when using the lower number of positions or keep it the same as for 20 positions?May i start a subject:

We have talked here and else where a lot about the number of positions in a system

I usually target 20 or so for risk management purpose.

Played a bit yesterday with backtesting this number of max positions and in my systems at least, daily and weekly:

I consistently got much better results with lower max number of positions.

For MA : along 2000+ trades so definitively consistent and statistically relevant?

And I'd like to know why!

One theory i have is with more positions, it might take longer to fill/refill after GTFO event or periods of mostly exits, or we just load with inferior trades then.

But on a 2 decades period..i would not expect that difference.

Obviously, the more positions, the nearer to the index we are but 20 positions in the XAO universe is not really index matching either..

You know my feelings about 2007 to now backtests, but to check these issues the difference in performance should be relevant...

So why would my systems perf be significantly and consistently better with let's say a max of 12 vs 20 positions.

Note: Some of these systems have a max number of new positions per bar

Looking forward to your views there

It is adjusted so more cash per position for lower nb of positionsDid you adjust your trade size when using the lower number of positions or keep it the same as for 20 positions?

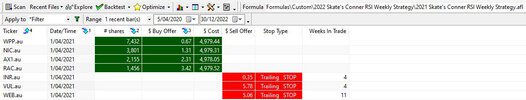

Like a lot of folks that follow this thread I live trade a weekly system. At the end of each calendar quarter I usually make a review of the trades I've done during the past quarter and do a general review of my systems' performance. Given we are about a year on since the Covid crash I was just reviewing how my systems have recovered since then. I thought it might be worthwhile doing a dump of how my live weekly system as performed over the past 12 or so months. The chart below tracks the unit value of my live weekly system. In summary my system was 100% cash through to about mid May 2020 and since then it has gone from a unit value of approx. 1.4 through to close today of approx. 2.10. This equates to a gain of approx. 50%. The covid crash saw the system encounter a rough DD of around 10% so over all my system as put on around 40% of the unit price going into the covid crash.

As you can see there has been some notable declines in the unit price (end of Jan this year through to around end of Feb) but overall it remains in a good up trend since the system "switched back on" in mid May of last year.

View attachment 122242

I recently posted the performance of my live weekly system so I thought I'd do a similar post on the performance of my live EOD system--the below is the unit price performance of my EOD system. This is a similar performance period to the post I made on my weekly system. My EOD system was pretty much turned off following the Covid crash until around mid-June, so it came back on later than my weekly but my EOD system is a more conservative system so this isn't surprising. As you can seen my EOD system went into DD after coming back on in June of 2020 and it went into a further DD of around 9%. However the system started to pick up around Oct 2020 and since then has been trending up. From the lows of the June 2020 DD my EOD as put on approximately around 23% to the end of last week. It hasn't had the gain that my live weekly system has (again not surprising as it is more conservative than my weekly) but it has still put on a reasonable recovery. My EOD has been been fully loaded with maximum open positions since around late Oct 2020 and has done only 3 trades since then. In contrast, my weekly system has made a lot more trades in the same period with around 20 trades.

View attachment 122426

It is adjusted so more cash per position for lower nb of positions

so $100k invested will go to 20 times $5k or if10 positions 10x $10k.

Then as the portfolio value increases decreases, i invest total equity divided by nb position per position.

It is managed automatically in the code

Ok, so without specifics of your sim results it is hard to know what is driving the difference but the thing that jumps out at me is that it is possible to "overtrade a system". Or maybe your system is just not fully invested with 20 positions as it is with 12 positions. The old adage--more trades doesn't == more profit. Perhaps your system performs better with few trades? The common technique of 20 positions each 5% is in many cases not the best solution

This does highlight something that I think is also worth careful consideration for system traders--position sizing. How much of a systems performance is attributable to the position sizing technique. I think it is very important to test your system with a range of different position sizing techniques.

Thanks MA, it is definitely an under worked area in my case as i stuck to this standard technique for the last 2 y.thanks for challenging this?

True, and i never really expect to trade with 100k position in real world especially for penny stocks..AB gives warning in backtest when you start virtual entries which are above traded volume.I'll be honest--I've raised this before some time ago here, but when I'm in the early stages of evaluating a system I always use a fixed dollar position size (not a % of portfolio value) because I think this gives me a much better understanding of how a system performs over a period of time. Think about this--if you are testing your system with the old 20 positions each 5% of portfolio value as you back test over time you generally take increasing $ position sizes over time. You might start with $5000 per position at the start and end up with position sizes of $250,000. The problem is that using this approach you are varying your position size as time goes on and the question then becomes how much of the systems performance was influenced by larger trade positions. This influence can be mitigated to a large degree by using a constant fixed $ position size over your entire backtest period. Typically, I would use a a fixed trade size of $5000 (max of 20 open positions) across the entire backtest period. I can then safely say that the performance of my system in backtests is not being unduly influenced by changes in trade size. Try it--you will be very surprised at how your system looks in backtests.

I found comparing 20-40 positions in my recent backtesting gave similar results to you, higher annual returns with fewer positions. Not sure if you experienced the same, but I had larger max DDs with fewer positions which I didn't feel was a worthwhile trade off.If i follow my gutfeel, i would go with at least 20 positions: lower individual stock risk, more spread among sectors etc so my gutfeel would much prefer it.

But i can not yet understand the constant better outcome of much lower numbers of max entries.

Is it due to my style: fast exits so a lot of trades.

Anyway not a clear understanding of the why.and this is disturbing..

I have a limit in number of entries per bar as a result of the same concernsI found comparing 20-40 positions in my recent backtesting gave similar results to you, higher annual returns with fewer positions. Not sure if you experienced the same, but I had larger max DDs with fewer positions which I didn't feel was a worthwhile trade off.

My current thinking is that 40 positions gives a larger spread potentially across sectors and during a downtrend you'll have a higher proportion of stocks holding or even gaining during a downtrend.

It's an interesting topic. One outstanding concern I have is going to cash and reinvesting on new buy signals. Should I be limiting to for example 5 new buys per bar or if the signals are there, take them all. The latter gave better results, but carries a higher timing risk imo

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?