- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Been there - done that

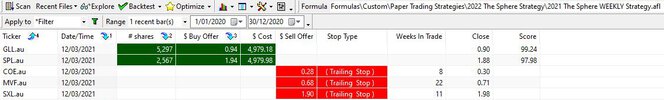

New traders spend a lot of time researching, reading articles, books & searching the forums looking for the best trade entry, with little or no effort in structuring an exit plan or a trading plan in general. Finding entry conditions as I said previously is a dime-a-dozen exercise. Whether the entry is based on trend breakouts or pullbacks within a trend or trend continuations it doesn't matter. There are multitudes of reasons to enter a trade, knowing when to get out is the "most" important.

Entries & Exits

Talking about just two parts of the strategy without even raising the idea of money management, position sizing or risk management is not doing justice to a system.

Confidence

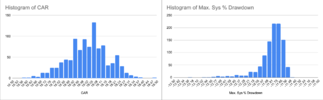

A trading strategy that times the "entry & exit" with good money management, position sizing & risk management than you have a strategy you can trade within your trading plan.

Time & Skill

Trading "mechanically" solves both issues that beginners face. If you have a good strategy, (in your opinion) you'll trade it with confidence the main ingredient in this game.

Skate.

New traders spend a lot of time researching, reading articles, books & searching the forums looking for the best trade entry, with little or no effort in structuring an exit plan or a trading plan in general. Finding entry conditions as I said previously is a dime-a-dozen exercise. Whether the entry is based on trend breakouts or pullbacks within a trend or trend continuations it doesn't matter. There are multitudes of reasons to enter a trade, knowing when to get out is the "most" important.

Entries & Exits

Talking about just two parts of the strategy without even raising the idea of money management, position sizing or risk management is not doing justice to a system.

Confidence

A trading strategy that times the "entry & exit" with good money management, position sizing & risk management than you have a strategy you can trade within your trading plan.

Time & Skill

Trading "mechanically" solves both issues that beginners face. If you have a good strategy, (in your opinion) you'll trade it with confidence the main ingredient in this game.

Skate.

)

)