MovingAverage

Just a retail hack

- Joined

- 23 January 2010

- Posts

- 1,315

- Reactions

- 2,565

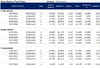

View attachment 107419

The order of construction

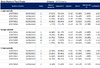

5. Add a sell condition

View attachment 107420

Skate.

Great posts @Skate . Quick question:- am I correct to assume there are two sell conditions in this system? A) when the stop is triggered; and B) the other being when the close crosses below the 25 period ma of the close?