- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Read a few of Duc's post & read the moderation of his words

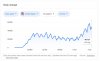

@ducati916 knows the shift has been on for a few weeks now & his projections are solid (his posts align with a few of my technical indicators). The shift is not like a light switch (on or off) but more like a dimmer switch & it's turning clockwise, the room is getting brighter.

@ducati916 nailed it

I'm keeping this quote from the Duc as it explains the current market sentiment of the ASX. The extremes have receded but the road we're travelling on still has a few potholes with the occasional hill to climb. Till playing with the dimmer switch ceases the room won't get back to full brightness (if that's even possible in the short term)

The market has been on a sprint. Markets are marathons. When they sprint, they also pause for breath. The pauses do not indicate a reversal is imminent. Simply a pause is a pause.

Negativity always reigns supreme when market sentiment starts to fluctuates

Waiting for clarity can be very costly as change can sneak up in small increments. Typically, a change in market sentiment starts slowly, similar to "boiling a frog in cold water" some traders will not perceive what's happening in the markets till it's too late to capitalise. Bull markets always follow bear markets but vary in magnitude. When markets start to change they can change more sneakily at times when battered traders least expect it.

News

With expectations already so low, any new news can boost the markets, even bad news that's lower than expected can also lift the markets. What we are experiencing at the moment is profit-taking when resistance is nearing. With each market pullback a "dead cat bounce" or it's a "sucker’s rally" gets thrown around like confetti. Over emphasise of bad news spins a potential positive into a negative because it better suits the current narrative. Those blinded by negativity have a habit of craving "clarity" that a change has begun. Those waiting for "clarity" have already missed some early big gains.

Duc's words

"The market has been on a sprint. Markets are marathons. When they sprint, they also pause for breath. The pauses do not indicate a reversal is imminent. Simply a pause is a pause".

If I may add to Duc's quote by saying

Markets are always forward-looking as well.

Skate.