Update on my MAP paper trading portfolio.

The index filter on my MAP Strategy has turned on this week and I have 6 signals to enter this Monday 11/05. The paper portfolio is so far in a drawdown of 12%.

The fact that this portfolio was only started in mid February this year has helped it in keeping the draw down to just 12% considering the steep sell off we have had. This is pure luck with the timing.

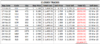

This week's scan results:

BUYS:

6 buys this week - MLX, PDN, WAF, RMS, MSB and PPH

SELLS:

No sells this week

The index filter on my MAP Strategy has turned on this week and I have 6 signals to enter this Monday 11/05. The paper portfolio is so far in a drawdown of 12%.

The fact that this portfolio was only started in mid February this year has helped it in keeping the draw down to just 12% considering the steep sell off we have had. This is pure luck with the timing.

This week's scan results:

BUYS:

6 buys this week - MLX, PDN, WAF, RMS, MSB and PPH

SELLS:

No sells this week