- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

The Action Strategy is now live & all updates from this point will be an ongoing record of the strategies progress.

Signals

I won't be posting the AmiBroker signals each week with the Friday's updates (to save confusion) but as there is nothing to post the first week, posting the signals is better than nothing. This week there is no shortage of signals.

Friday's weekly update

Will be a summary of the weeks performance.

Suspended & delisted securities

There are some things that can be coded into a strategy where others are a little more difficult. The analysis report will not include "Suspended or delisted securities" . Being hit by a bus is a little harder to code as is ASX announcements so they will be checked for the reason below.

What overrides a buy signal

There is only one thing that will override a buy signal & that's an announcement of a takeover or a scheme of arrangement.

FYI

A "scheme of arrangement" is a court-approved agreement between a company & its shareholders regarding the compulsory acquisition of all the outstanding shares.

Positions placed in the pre-auction

The positions placed in the pre-auction will be posted tomorrow (Saturday) after they have been entered into CommSec as filtering the announcements of each individual companies is required.

Monday's report

On Monday I'll post the reports from "Share Trade Tracker" with confirmations of the positions executed.

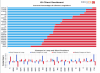

This weeks signals

Luck

In life & trading we all need a bit of luck to be successful.

My next post

After the positions have been placed in the pre-auction I will post a confirmation tomorrow (Saturday)

Skate.