- Joined

- 13 February 2006

- Posts

- 5,487

- Reactions

- 12,987

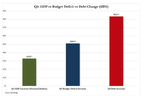

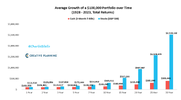

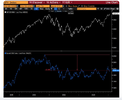

Re. the BTC: some money managers (most) see BTC volatility as a risk. The US Federal debt has grown at 8%CAGR for 15yrs. UST yields during that time have been at or close to ZIRP. So negative returns on low volatility is what they have achieved.

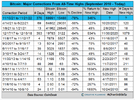

Am I a big BTC fan? No. But those charts above demonstrate that the vast majority of BTC is being held by individuals. Volatility is not risk. Volatility is simply an opportunity. Now of course, ultimately anything with high volatility, to negate the risk, must move higher and not blow-up to fall to zero. Otherwise it is indeed risk.

jog on

duc