DrBourse

If you don't Ask, You don't Get.

- Joined

- 14 January 2010

- Posts

- 892

- Reactions

- 2,118

An Overview of Indicator Parameters.

Attachments

-

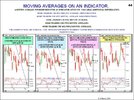

Page 036 Indicator Signals.JPG324.7 KB · Views: 28

Page 036 Indicator Signals.JPG324.7 KB · Views: 28 -

Page 037 Indicator Signals 1.JPG113.6 KB · Views: 28

Page 037 Indicator Signals 1.JPG113.6 KB · Views: 28 -

Page 038 Indicator Signals 2.JPG101.1 KB · Views: 22

Page 038 Indicator Signals 2.JPG101.1 KB · Views: 22 -

Page 039 Indicator Signals 3.JPG93.9 KB · Views: 20

Page 039 Indicator Signals 3.JPG93.9 KB · Views: 20 -

Page 040 Indicator Signals 4.JPG86.2 KB · Views: 16

Page 040 Indicator Signals 4.JPG86.2 KB · Views: 16 -

Page 041 Indicator Signals 5.JPG88.9 KB · Views: 15

Page 041 Indicator Signals 5.JPG88.9 KB · Views: 15 -

Page 042 Indicator Signals 6 - Copy.JPG70.8 KB · Views: 16

Page 042 Indicator Signals 6 - Copy.JPG70.8 KB · Views: 16 -

Page 042 Indicator Signals 6.JPG70.8 KB · Views: 16

Page 042 Indicator Signals 6.JPG70.8 KB · Views: 16 -

Page 043 Indicator Signals 7.JPG114.6 KB · Views: 16

Page 043 Indicator Signals 7.JPG114.6 KB · Views: 16 -

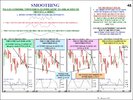

Page 044 Smoothing.JPG166.5 KB · Views: 14

Page 044 Smoothing.JPG166.5 KB · Views: 14 -

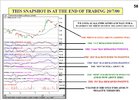

Page 045 Divergences.JPG148.9 KB · Views: 17

Page 045 Divergences.JPG148.9 KB · Views: 17 -

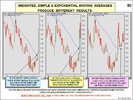

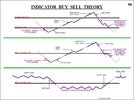

Page 046 Indicator Buy Sell Theory.JPG78.8 KB · Views: 21

Page 046 Indicator Buy Sell Theory.JPG78.8 KB · Views: 21