Interesting interview with Gary Shilling. Click on the link just under the main stories at the top of the page.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dr Doom - Correction to be 30%

- Thread starter wayneL

- Start date

- Joined

- 13 April 2007

- Posts

- 801

- Reactions

- 0

Dr Doom isn't telling us anything that hasn't been said before.

Here is the original bear of them all

Here is the original bear of them all

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,954

- Reactions

- 13,247

LOLInteresting interview with Gary Shilling. Click on the link just under the main stories at the top of the page.

* "It might blow up before it blows over"

* Problems spreading to prime

* People have unrealistic expectations of returns as a result of dot com boom and credit expansion

* Recession before the end of the year. "inevitable"

* Spending supported by HPI, that's now gone

* CBs very worried

* Recession to be deflationary

* Liquidity all based on debt

* Remarks on ABX index Crash

* Short term cash injection (repos) useless and won't work.

* Consumers have been spending beyond their income.

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

LOL

* "It might blow up before it blows over"

* Problems spreading to prime

* People have unrealistic expectations of returns as a result of dot com boom and credit expansion

* Recession before the end of the year. "inevitable"

* Spending supported by HPI, that's now gone

* CBs very worried

* Recession to be deflationary

* Liquidity all based on debt

* Remarks on ABX index Crash

* Short term cash injection (repos) useless and won't work.

* Consumers have been spending beyond their income.

So nothing we all don't know already then.

Don't lets all forget that the market is more than capable of reacting irrationally on any type of news or event.

If the press is reporting more on the bearish side of things, probably time to buy.

Anyway however complex we try and make it by discussing how the credit bubble may swing us into world recession the simple fact is the market is driven by supply and demand.If the Dow reaches 13000 and the illusion of value is believed by the masses, we will be up to new highs in no time, recession or not.

personally I am 2/3rds cash, but I am a scaredy cat

wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,954

- Reactions

- 13,247

Depends on availability of credit. A bona fide crunch will sap cash out of asset markets quicker than you can say Jack Robinson... positive sentiment or not.So nothing we all don't know already then.

Don't lets all forget that the market is more than capable of reacting irrationally on any type of news or event.

If the press is reporting more on the bearish side of things, probably time to buy.

Anyway however complex we try and make it by discussing how the credit bubble may swing us into world recession the simple fact is the market is driven by supply and demand.If the Dow reaches 13000 and the illusion of value is believed by the masses, we will be up to new highs in no time, recession or not.

personally I am 2/3rds cash, but I am a scaredy cat

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

Whatever happens, there are some certainties.

First, the US, by virtue of its "repo" bailouts, will accelerate the rate of decline of US dollars.

Second, the demand for energy will continue to increase, although a global depression might decelerate that rate for a very brief period.

Third, global populations will continue to incease, and the need for infrastructure at an exponentially increasing basis until third world economies catch up, will ensure that product and service demand will turn around any bear market more quickly than in the past.

Finally, the response of Central Banks to the present prime-crisis is unprecedented. Only time will tell, but the likelood of a soft landing being doctored by the money merchants is not something we can readily overlook.

First, the US, by virtue of its "repo" bailouts, will accelerate the rate of decline of US dollars.

Second, the demand for energy will continue to increase, although a global depression might decelerate that rate for a very brief period.

Third, global populations will continue to incease, and the need for infrastructure at an exponentially increasing basis until third world economies catch up, will ensure that product and service demand will turn around any bear market more quickly than in the past.

Finally, the response of Central Banks to the present prime-crisis is unprecedented. Only time will tell, but the likelood of a soft landing being doctored by the money merchants is not something we can readily overlook.

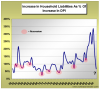

One theme that is not new but keeps recurring is that US households have been spending beyond their means for years. When households change their spending habits and start to save more, which hasn't happened for a while it can be a good leading indicator of a recession.

This article contains some interesting charts that point out some recent multi-year and in some instances multi - decade trend breaks. The most illustrative of these is the one below which shows the increase in household liabilities as a percentage of the increase in disposable personal income. The red dots mark prior US recessions. The following comes directly from the article:

This article contains some interesting charts that point out some recent multi-year and in some instances multi - decade trend breaks. The most illustrative of these is the one below which shows the increase in household liabilities as a percentage of the increase in disposable personal income. The red dots mark prior US recessions. The following comes directly from the article:

Each one of these recessionary periods is characterized as having happened with a decline in this ratio. Of course absolutely nothing over the last half century even comes close to what has occurred over the last five+ years in terms of the magnitude of expansion and contraction.

Attachments

I think kennas is the first one to really look at the fundamentals.

the 2 important economic variables according to Richard Farleigh are inflation and economic growth, which should be checked every 3 months.

checklist for inflation with a score of -3 to +3 compared to 3 months ago concerning:

wages, unemployment, exchange rate, commodity prices,

input prices, capacity realisation

checklist for economic growth concerning:

retail sales, employment, housing, consumer confidence, business confidence, industrial production, government surplus/deficit, gross national product.

I think that this is a far better way of keeping a finger on the pulse than argueing who can do forecasting the best.

Just my opinion.

the 2 important economic variables according to Richard Farleigh are inflation and economic growth, which should be checked every 3 months.

checklist for inflation with a score of -3 to +3 compared to 3 months ago concerning:

wages, unemployment, exchange rate, commodity prices,

input prices, capacity realisation

checklist for economic growth concerning:

retail sales, employment, housing, consumer confidence, business confidence, industrial production, government surplus/deficit, gross national product.

I think that this is a far better way of keeping a finger on the pulse than argueing who can do forecasting the best.

Just my opinion.

I think kennas is the first one to really look at the fundamentals.

I think your dreadfully wrong. Kennas recently admitted on a another thread that he is 'no economist' (they were his exact words I think) and his lack of knowledge on 'the fundamentals' is obvious. I'm not having a go at kennas here just stating that I don't believe kennas is one to consult on fundamentals.

the 2 important economic variables according to Richard Farleigh are inflation and economic growth, which should be checked every 3 months.

Who the hell is Richard Farleigh?

checklist for inflation with a score of -3 to +3 compared to 3 months ago concerning:

wages, unemployment, exchange rate, commodity prices,

input prices, capacity realisation

checklist for economic growth concerning:

retail sales, employment, housing, consumer confidence, business confidence, industrial production, government surplus/deficit, gross national product.

So what scores are we at now? What do they tell us? What are Richard Farleigh's forecasts for the next 3,6,12 months?

I think that this is a far better way of keeping a finger on the pulse than argueing who can do forecasting the best.

The original post contains an interview with Marc Faber who gives numerous fundamental reasons why he sees a correction due in the markets. Those who have no arguments to counter Faber's are the ones who started the pissing contest over the accuracy of forecasters.

chops_a_must

Printing My Own Money

- Joined

- 1 November 2006

- Posts

- 4,636

- Reactions

- 3

I disagree with the first statement, agree with the rest.Whatever happens, there are some certainties.

First, the US, by virtue of its "repo" bailouts, will accelerate the rate of decline of US dollars.

Second, the demand for energy will continue to increase, although a global depression might decelerate that rate for a very brief period.

Third, global populations will continue to incease, and the need for infrastructure at an exponentially increasing basis until third world economies catch up, will ensure that product and service demand will turn around any bear market more quickly than in the past.

Finally, the response of Central Banks to the present prime-crisis is unprecedented. Only time will tell, but the likelood of a soft landing being doctored by the money merchants is not something we can readily overlook.

If everyone goes to cash, that is bullish for the dollar. I think CB's will eventually realise they can't put fingers in the holes of all these leaks, and asset prices will tank, as they have been pumped up through credit, eventually having a deflationary impact. A reduction on debt in a currency in my view is bullish for that currency. And as people reduce debt, cash levels increase.

There has to be at some point a decoupling of the markets of developed nations and those of the developing world. I am of the belief the commodities boom is the result of civil construction and development in the developing nations. I don't think all of these commodities are being used to produce retail goods like clothes and things.

But if this is a prolonged correction, commodities will go down with the ship, but I think that is aside from the longer term picture. Watch for the chinese to sure up long term supply contracts... That is going to be my cue...

Here's one for the bulls.

Onward and upward!

"I fully expect the markets to recover and in particular international markets to rally in the fourth quarter and to close at record highs by the end of the year".

Onward and upward!

Who the hell is Richard Farleigh?

Richard Farleigh used to run a hedge fund in Bermuda. Now he lives in Monte Carlo. Worth about $160million. Knows a fair bit about trading.

He also wrote the book Taming the Lion.

More info here:

http://en.wikipedia.org/wiki/Richard_Farleigh

- Joined

- 15 September 2004

- Posts

- 364

- Reactions

- 2

From http://en.wikipedia.org/wiki/Great_Depression

The present???...

And the future....

So the solution to excess borrowing (and with it the risk of asset price led deflation) is to provide more liquidity (ie borrow more)...

While at the same time central banks around the world pat themselves on the back and claim to have contained inflation.....

You can have it one way or the other - but not both... I think the path of least resisitance is to go for the inflation route. Inflate away the debt and the future pension obligations (lenders lose), but this will rely on consumers not losing confidence in taking on debt... if they do then I think debt induced deflation is the more likely (lenders win)

The present???...

Macroeconomists, including the current chairman of the U.S. Federal Reserve Bank System Ben Bernanke, have revived the debt-deflation view of the Great Depression originated by Arthur Cecil Pigou and Irving Fisher. In the 1920s, in the U.S. the widespread use of purchases of businesses and factories on credit and the use of home mortgages and credit purchases of automobiles, furniture and even some stocks boosted spending but created consumer and commercial debt. People and businesses who were deeply in debt when a price deflation occurred or demand for their product decreased were often in serious trouble””even if they kept their jobs, they risked default. Many drastically cut current spending to keep up time payments, thus lowering demand for new products. Businesses began to fail as construction work and factory orders plunged.

And the future....

Monetarists, including Milton Friedman and Benjamin Bernanke, argue that the Great Depression was caused by monetary contraction, which was the consequence of poor policy making by the American Federal Reserve System and continuous crisis in the banking system.[4] By not acting, the Federal Reserve allowed the money supply to shrink by one-third from 1930 to 1931. Friedman argued[5] the downward turn in the economy starting with the stock market crash would have been just another recession. The problem was that some large, public bank failures, particularly the Huntly New York Bank of the United States, produced panic and widespread runs on local banks, and that the Federal Reserve sat idly by while banks fell. He claimed if the Fed had provided emergency lending to these key banks, or simply bought government bonds on the open market to provide liquidity and increase the quantity of money after the key banks fell, all the rest of the banks would not have fallen after the large ones did and the money supply would not have fallen to the extent and at the speed that it did.[6] With significantly less money to go around, businessmen could not get new loans and could not even get their old loans renewed, forcing many to stop investing. This interpretation blames the Federal Reserve for inaction, especially the New York branch, which was owned and controlled by Wall Street bankers. The Federal Reserve, by design, is not controlled by the President or the U.S. Treasury; it is primarily controlled by member banks and the chairman of the Federal Reserve.[7]

So the solution to excess borrowing (and with it the risk of asset price led deflation) is to provide more liquidity (ie borrow more)...

While at the same time central banks around the world pat themselves on the back and claim to have contained inflation.....

You can have it one way or the other - but not both... I think the path of least resisitance is to go for the inflation route. Inflate away the debt and the future pension obligations (lenders lose), but this will rely on consumers not losing confidence in taking on debt... if they do then I think debt induced deflation is the more likely (lenders win)

- Joined

- 29 January 2006

- Posts

- 7,217

- Reactions

- 4,438

It really doesn't work like that.I disagree with the first statement, agree with the rest.

If everyone goes to cash, that is bullish for the dollar. I think CB's will eventually realise they can't put fingers in the holes of all these leaks, and asset prices will tank, as they have been pumped up through credit, eventually having a deflationary impact. A reduction on debt in a currency in my view is bullish for that currency. And as people reduce debt, cash levels increase.

......

Value should be asset-backed, not debt riddled.

As the US is in the latter camp, the greenback must decline further, and further.

Inflating money supply decreases asset value and therefore the currency's value is set on a downward path hereonin.

Your implication that the Fed has reduced debt on a currency, and that therefore is bullish, foresakes the origin of the capacity to reduce debt.

I had reckoned the Oz dollar would hit parity with the greenback 3 years or so down the track. I will now bring that forward a year, and anticipate parity will be an established theme in 2010.

numbercruncher

Beware of Dropbears

- Joined

- 12 October 2006

- Posts

- 3,136

- Reactions

- 1

- Joined

- 14 June 2007

- Posts

- 1,130

- Reactions

- 3

Any of you economist types have any idea of how forced investing via super will play out here? And second, how could/will this be offset via babyboomers retiring and ripping money out of super to protect it in a falling market?

With the tax effectiveness of super in Australia, I'm wondering if that will have much of a cushioning effect on any fall here. Not much of an economist

so I don't know.

With the tax effectiveness of super in Australia, I'm wondering if that will have much of a cushioning effect on any fall here. Not much of an economist

so I don't know.

- Joined

- 12 April 2005

- Posts

- 842

- Reactions

- 0

From http://en.wikipedia.org/wiki/Great_Depression

The present???...

And the future....

So the solution to excess borrowing (and with it the risk of asset price led deflation) is to provide more liquidity (ie borrow more)...

While at the same time central banks around the world pat themselves on the back and claim to have contained inflation.....

You can have it one way or the other - but not both... I think the path of least resisitance is to go for the inflation route. Inflate away the debt and the future pension obligations (lenders lose), but this will rely on consumers not losing confidence in taking on debt... if they do then I think debt induced deflation is the more likely (lenders win)

The limitation in the 1920's right upto 1972 was that the US Dollar was actually worth something tangible. That is, it was convertable into gold so the convertability limited the ability to pump liquidity as people would demand the gold instead of US dollars.

Which is what started to happen leading into 1972 which forced Nixon to close the gold window.

Another interview with Marc Faber. Click on the link below the main stories.

"Overall I think we are already headed into recession and it will manifest itself say within the next 3 - 6 months"

"Overall I think we are already headed into recession and it will manifest itself say within the next 3 - 6 months"

Similar threads

- Replies

- 50

- Views

- 5K

- Replies

- 93

- Views

- 17K