- Joined

- 20 August 2013

- Posts

- 896

- Reactions

- 10

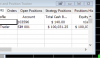

As far as 5 bad trades in the bonds, my stops are usually tight. Im only aiming for maybe 2 points a day. Youve got a 14 atr range and it feels as though they have a much more ebb and flow character which means it comes more down to timing the trade and you have a better chance of getting out of a bad decision.