- Joined

- 6 January 2016

- Posts

- 254

- Reactions

- 187

Here is the link http://bettersystemtrader.com/037-cesar-alvarez-studies-stop-losses/

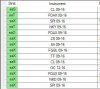

Trendnomics system gives his stocks lots of time and room to move, so that when the inevitable dips occur, the loss or reduced profit is not taken at that time if the dip recovers within the shorter term. The attached chart shows some of the benefits of such concepts. Interestingly, on this model, the Feb '16 D/D was more acute than any other during the period.

View attachment 67763

Correct - no stop losses and equal position sizing. I'm not trying to avoid draw-downs. I embrace draw-downs, due to equity market draw-down occurrences, consequently supporting my positive expectancy (i.e. everyone is trying to avoid draw-downs, by chasing high sharpe ratios). Also, there are strong risk-reward relationships - the higher the risk the greater the reward.