- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

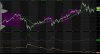

Likely Multi-charts and IB. So i need to get the operational versions all re-coded in EL.

I've had so many ideas to code over the years but couldn't find a decent coder that was reasonably priced, friendly and fast....until this year. Its been a great year for system development and because i have a quiet office, i get allot of work done.

Yeh some people definitely have a knack for coding - speed/precision/originality. The best of the best seem to write in 2 lines what others take 50 lines to do. Trash used to be like that with AB.

When you go live with the automation, can you post a video? Would like to see how it works.