- Joined

- 14 May 2013

- Posts

- 309

- Reactions

- 274

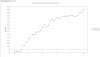

Recent returns on my multi system portfolio, last 100 days in most cases. In a couple of cases where the systems trade less frequently there are no trades at all.

Overall, certainly worth continued testing. These results are just the back tests on recent unseen data, not live results or live results on simulated accounts.

how much starting capital do you have in your system canoz?

Also what data do you use?

thanks!