- Joined

- 8 June 2008

- Posts

- 12,804

- Reactions

- 18,734

Vix is weird???

Anyway, we should not hijack DDD

Have all a great day

Vix is weird???

hijack , more like confirming his suspicions/predictionsVix is weird???

Anyway, we should not hijack DDD

Have all a great day

US Graphite Producers Demand Massive Tariffs. US producers of graphite have filed petitions with two federal agencies this week, asking for investigations on potential Chinese violations of anti-dumping laws and demanding that the White House slap a punitive 920% tariff on China-produced graphite.

Or not use graphite but alternatives, when there is a will,there is a mean?920% tariff? Yikes. What's the second, third order effects of this? Is it going to change the price of graphite world wide, or just encourage US and other western companies to hop to it with graphite mine delivery.

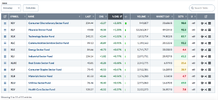

View attachment 189906

Thank you @ducati916 for your DDD contributions throughout the year. I enjoy reading them even if I don't understand the underlying macro-economics of most of them. The maths behind the MSTR accumulation of BTC went over my head by 10,000 ft. MSTR was easy to trade earlier in the year but it's now becoming too volatile. I agree that there's going to be a disastrous implosion with this. Don't know how and don't know when.

I keep an eye on the oil, gold and USD news as they pertain to my positions. Thanks for those.

I do miss my daily dose of Fly. Amongst all the emotional outbursts there was wit and humour along with a stock tip or two. He frequently brought stocks to my attention that I'd not seen.

I'll be doing a lot more trading in the US market next year. I don't expect the US to have another year of rising prices like this year but there's just so many more trading opportunities than in the ASX.

Reports from NZ say that you're doing it tough with the high costs of living. Much worse than Aust and so bad, that many are crossing the ditch. I trust that a person of your talent should be OK and enjoy a festive holiday period.

sadly i think you are correctUnlike 2020, you can't buy this dip.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.