- Joined

- 10 March 2009

- Posts

- 466

- Reactions

- 484

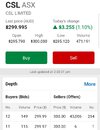

January update for the 2024 stock tipping comp. CSL has recovered slightly up 3.8% so far this month. On track to give a modest return over the next few months. On track from my perspective

Iggy

Iggy