DrBourse

If you don't Ask, you don't Get.

- Joined

- 14 January 2010

- Posts

- 888

- Reactions

- 2,091

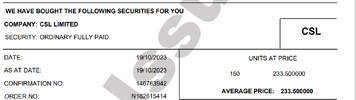

CSL is at a Crutial Point, Will it CRASH & BURN as before, OR will it continue with its curreny ST Uptrend....Will History Repeat itself again….

CSL has seen 3 predictable Drops within 3 Zones – Look at the ? on the chart, are we now going to get 3 Tweezer Top (etc) within 3 Zones – Only time will tell, at present, if the 3rd TT does eventuate (on a bounce up to the $242.02 Line), it may well be that the following drop could be to the $223.16 Line, Hmmmmm…

View attachment 164660

Any Other Opinions out there