- Joined

- 25 December 2018

- Posts

- 258

- Reactions

- 232

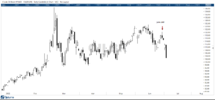

There are two scenarios that could prevail so I have presented two price Curves to cover both outcomes - If we continue to drop into the 28th June we could potentially be Low -/+1 on this date so that is the first scenario that could prevail and as the 28th is only a few days away it would be wise to wait for this date to roll around and see how the market is moving into this point . If we do get Low we could be up till the 7th July then down till the 14th July . Previous rallies in July ran out 18.36% and 20% so we may be looking at a rally of this magnitude if we get Low on the 28th June .

The second scenario is a Low into the 7th July then up till the 14th July for counter trend Top so we have a comprehensive framework to check against the position of the market . The three key dates are the 24th June - 7th July and 14th July so once these dates come in and present us with a clear sense of direction we can look to trade out of those dates into the next time period .

studentofgann.com.au

The second scenario is a Low into the 7th July then up till the 14th July for counter trend Top so we have a comprehensive framework to check against the position of the market . The three key dates are the 24th June - 7th July and 14th July so once these dates come in and present us with a clear sense of direction we can look to trade out of those dates into the next time period .

studentofgann.com.au