UMike

Klutzing in Thai

- Joined

- 16 January 2007

- Posts

- 1,466

- Reactions

- 1,829

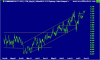

Ahhh well I got it.....

A bit before I thought I would and it closed a cent higher also.....

Lets hope it all picks up from now. (with a divi).

A bit before I thought I would and it closed a cent higher also.....

Lets hope it all picks up from now. (with a divi).