nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

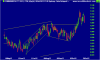

It is like trying to kill a snake. The bloody thing keeps moving agressively upward when you least expect it. Coming off a low of $1.035, cpa slithered up to a fresh high of $1.08 before dropping back to $1.055.

All week it has met support at the $1.055 level but the interday highs are getting lower. This wouldn't be a bad time for the break-out experts to chime and with their opinions as to whether cpa can hold this point and go higher or is about to crash downwards. I have a low ball bid in the queue just in case but I'm not confident. As always do your own research and good luck .

.

All week it has met support at the $1.055 level but the interday highs are getting lower. This wouldn't be a bad time for the break-out experts to chime and with their opinions as to whether cpa can hold this point and go higher or is about to crash downwards. I have a low ball bid in the queue just in case but I'm not confident. As always do your own research and good luck