- Joined

- 2 April 2006

- Posts

- 252

- Reactions

- 0

Howard said so, so it must be correct . . . . LOL

Howard backs Costello on mining downturn - 1st November - The Australian.

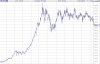

The resources sector should continue to make a very big contribution to Australia's wealth but the reality was that there had been a dip in the sector, Mr Howard said today.

Howard backs Costello on mining downturn - 1st November - The Australian.

The resources sector should continue to make a very big contribution to Australia's wealth but the reality was that there had been a dip in the sector, Mr Howard said today.