wayneL

VIVA LA LIBERTAD, CARAJO!

- Joined

- 9 July 2004

- Posts

- 25,953

- Reactions

- 13,247

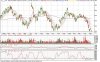

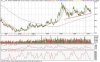

A textbook trangle trend continuation pattern set up there in cocoa.This ones on my watchlist now.

If it breaks out I want to be on it as well to pay for the organic cocoa missus buys

...maybe i'll take delivery of a contract, 10 tonnes should keep us going for a while.