- Joined

- 2 February 2006

- Posts

- 14,009

- Reactions

- 2,894

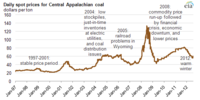

It is very difficult to solve this coal situation as companies will move to oil, if they can, if coal prices move higher. Lovely for Bayan as much of its coal is low grade thermal particularly from its Tabang mine. Australia has its thumb in the pie with Kangaroo Resources Limited now 100% owned by Bayan but the shares are held frozen in Australia by The High Court in Canberra.

www.spglobal.com

www.spglobal.com

China's plans are to extend the use of coal fired power stations despite saying the opposite.

time.com

time.com

China had 1,082 power stations at the end of 2020 ( use VPN or you may be blocked for multiple visits ):

So basically China is having a laugh when it says we are planning to cut emissions. What they are really saying is that in the more developed parts of China new technology will bring about less emissions. But in the North of China they will carry on building coal fired power stations. Yes, less power stations built each year because they will be getting closer to the final number required.

Coal emissions will effect those in the North of China but further south where all the money clout is emissions will reduce. So heigh-ho, we have reduced emissions and slowed down the number of coal fired power stations being built.

Bayan Resources completes A$515.2M acquisition of Kangaroo Resources

The company offered 15 Australian cents per share in mid-August, valuing Kangaroo at A$515.2 million.

WEC: WA Court expands terms of freezing order against Bayan

ASX Release ASX Release The Manager Company Announcements Office Australian Stock Exchange WA SUPREME COURT...

www.marketscreener.com

China's plans are to extend the use of coal fired power stations despite saying the opposite.

China Is Planning to Build 43 New Coal-Fired Power Plants. Can It Still Keep Its Promises to Cut Emissions?

20 August 2021

China Is Planning 43 New Coal-Fired Power Plants. Can It Still Keep Its Promises to Cut Emissions?

China built three times more new coal power capacity as all other countries in the world combined in 2020.

China had 1,082 power stations at the end of 2020 ( use VPN or you may be blocked for multiple visits ):

Number of coal power plants by country 2021 | Statista

Mainland China has the greatest number of coal-fired power stations of any nation in the world.

www.statista.com

www.statista.com

Number of coal power plants by country 2021 | Statista

Mainland China has the greatest number of coal-fired power stations of any nation in the world.

So basically China is having a laugh when it says we are planning to cut emissions. What they are really saying is that in the more developed parts of China new technology will bring about less emissions. But in the North of China they will carry on building coal fired power stations. Yes, less power stations built each year because they will be getting closer to the final number required.

Coal emissions will effect those in the North of China but further south where all the money clout is emissions will reduce. So heigh-ho, we have reduced emissions and slowed down the number of coal fired power stations being built.

Last edited: