pixel

DIY Trader

- Joined

- 3 February 2010

- Posts

- 5,359

- Reactions

- 345

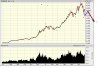

Just in case someone is actually looking North: Let's look at the Shanghai Composite over recent years.

The 3-year Weekly chart suggests that we may now be at a more significant resistance level. So it will pay to watch out for either a bounce down off a ceiling, or a break and re-test from above.

Now switching to the Daily chart, and since mid-year, China has again been going places. Recently, trading volume has also picked up noticeably:

The usual pullback from Fib Phi and 200% has been preceded each time by a divergent drop of Momentum. Nothing surprising there. Simply watch the rising trend line. If it breaks, we'll have a changed situation.

The 3-year Weekly chart suggests that we may now be at a more significant resistance level. So it will pay to watch out for either a bounce down off a ceiling, or a break and re-test from above.

Now switching to the Daily chart, and since mid-year, China has again been going places. Recently, trading volume has also picked up noticeably:

The usual pullback from Fib Phi and 200% has been preceded each time by a divergent drop of Momentum. Nothing surprising there. Simply watch the rising trend line. If it breaks, we'll have a changed situation.