- Joined

- 15 June 2008

- Posts

- 184

- Reactions

- 0

This one came up on a scan a little while ago.. looks like it might have some legs, with a wave 3 starting. I'll post a chart after work..

Did CHC - Charter Hall Group change symbol and name?

Comes up as invalid code, so something must have happened.

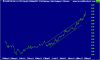

CHC looking good, approaching all time high of $7.29 and good volume over the last few days.

No news that I can see so will be interesting to see where she goes.

A good trend comes to an end on the daily and weekly charts.

The recently announces SIA with ABP to acquire AOF seems to have upset some longer term holders (and therefore me).

View attachment 97366

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.