CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Copper is headed towards an abyss

Have you traded any of these systems live that you've had developed over the last few years CanOz? If so how have they gone?

Probably there will be ease of movement in low volume areas, but that's way too hard to determine from a VAP chart. There's just too many places you can set the interval, and when you change the interval, the whole landscape changes. Personally I can't find a use for volume at price style charts.

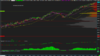

An idea of what today was like on Honkers....

Anticipating a tight range today, we've got this Bot setup to trade longs above 12590 and shorts below 12484View attachment 88238

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.