UMike

Klutzing in Thai

- Joined

- 16 January 2007

- Posts

- 1,484

- Reactions

- 1,852

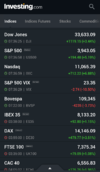

Yea.Seems to me that buying this dip is more like buying the slide.

Has anyone mentioned to sell the peaks?

Selling the Bump on ASX

As the resident bottom picker there is a time you have to pick the "Bump" to realise your gains. Not so much looking for the top..... That is something at times unattainable. I mean whose to say this is the top but if you don't take a profit now then how can you confidently but again on the...

www.aussiestockforums.com

www.aussiestockforums.com