Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

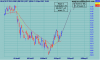

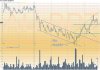

Thought it time for an update on BPT.

It came up on a scan today and I must admit I like the set up.

Reasonable low risk entry with very good support at 1.03, bounced off that area 3 times now.

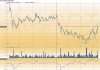

Also we have some good type A divergence (the best ).

From an Elliot wave perspective, looks like the 3 wave correction may have completed.Today however wasn't so good so maybe not quite time for an entry yet, looks good to me though.

It came up on a scan today and I must admit I like the set up.

Reasonable low risk entry with very good support at 1.03, bounced off that area 3 times now.

Also we have some good type A divergence (the best ).

From an Elliot wave perspective, looks like the 3 wave correction may have completed.Today however wasn't so good so maybe not quite time for an entry yet, looks good to me though.