- Joined

- 12 January 2011

- Posts

- 39

- Reactions

- 0

http://www.thebull.com.au/articles/a/16819-seven-boq-branches-shut-in-qld.html

Share price hit hard. Good buying oppitunity?

Share price hit hard. Good buying oppitunity?

I jumped in at $12.00 - now running around $8.00. I would be grateful for your considered opinion as to whether they will EVER get back to 12 or 13 dollars? Thanks for your help.

Regards Adrian (Newbie)

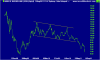

All the banks seem to be suffering at present from the overall market malaise plus a fear of contagion from the mess in Europe, but BOQ (just having a quick look at the chart) has seen its SP drop more than the others.

Considered to be related to the exposure of the QLD Bank to flood effected Qld Mortgages. As the effected areas recover so will the mortgages and the bank share price. Sub $8.00 would have been a good entry price.

Thanks for the replies folks...my plan was for long term but my question remains..can anyone see them coming back to a $12/13 dollar level at some stage ie 1, 2 or 3 years? Realise a bit of crystal ball stuff will be required...

Thanks for the replies folks...my plan was for long term but my question remains..can anyone see them coming back to a $12/13 dollar level at some stage ie 1, 2 or 3 years? Realise a bit of crystal ball stuff will be required...

I think short on this one at present, it is in a long term down trend, possibly going down toward previous lows to around the $7.65 mark, unless there is a break of trend confirmed at the $8.72 mark or above, I don't think is likely.

Poppasan

Looks like BOQ investors think differently. Go boq for holders.

This stock is really in the doldrums.....can anybody see any light at the end of my gloomy tunnel? Cheers

The first loss by an Australian bank in twenty years...

Yeh i saw that. Is it the first sign of things to come, or a once of?

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.