You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BNB - Babcock & Brown

- Thread starter Dakaz

- Start date

-

- Tags

- babcock & brown bnb

Yep it certainly is time to re-assess. BUY MORE !!!! This is an outstanding price for this stock. I know the world is in a state of panic, but its just a hiccup that had to happen IMHO.

As the great KP said, buy when everyone is selling and sell when everyone is buying.

As the great KP said, buy when everyone is selling and sell when everyone is buying.

- Joined

- 19 April 2007

- Posts

- 71

- Reactions

- 0

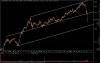

A picture is worth a thousand words, and so here's a chart of BNB for your viewing pleasure. Personally, I think 18.7 should hold, but nothing is for certain.

Lol, minutes after saying 18.7 should hold, it goes sub 18!!! Talk about panic.

Good luck to those holding this.

Lol, minutes after saying 18.7 should hold, it goes sub 18!!! Talk about panic.

Good luck to those holding this.

Attachments

Yep it certainly is time to re-assess. BUY MORE !!!! This is an outstanding price for this stock. I know the world is in a state of panic, but its just a hiccup that had to happen IMHO.

As the great KP said, buy when everyone is selling and sell when everyone is buying.

Well u gotta be very brave to top up now..im gona sit on the fence for a while..i've lossed enough and im not willing to take the risk in this kinda market..its gona take a hell lot longer for the markets to recover..many investors are scared sh_tless..time to build up my war chess..and look to re-enter after the panic is truely gone. Its better to follow the crowd..rather than be the brave on in situations like this..(but then again..fortune favours the brave)

- Joined

- 2 March 2007

- Posts

- 233

- Reactions

- 0

never thought it would get this low, almost half of its recent high of $35.

and yeh its gonna take longer than thought to recover I think.

Just hope it DOES recover and all this clears up soon.

I definately jumped the gun on this one.

But, still, I think their fundamentals are still strong, and once (if?) the market gets back to trading on something other than fear and rumors, it will be strong.

and yeh its gonna take longer than thought to recover I think.

Just hope it DOES recover and all this clears up soon.

I definately jumped the gun on this one.

But, still, I think their fundamentals are still strong, and once (if?) the market gets back to trading on something other than fear and rumors, it will be strong.

"BUT there is no need to try and be a hero by stepping in front of a freight train."

Hero?

I guess I might be missing something or maybe not just not smart enough to know when to pick the bottoms, but then again im not a trader. But I just could be speaking of holding BNB since listing and see no reason to be fearful.

The point in making is that if you buy quality it really doesnt matter what price you get if you are a long term investor have no 'exit' strategy. Be it 26 a few days ago or 19 today or 15 tomorrow.

Anyway, I enjoy the posts.

Hero?

I guess I might be missing something or maybe not just not smart enough to know when to pick the bottoms, but then again im not a trader. But I just could be speaking of holding BNB since listing and see no reason to be fearful.

The point in making is that if you buy quality it really doesnt matter what price you get if you are a long term investor have no 'exit' strategy. Be it 26 a few days ago or 19 today or 15 tomorrow.

Anyway, I enjoy the posts.

- Joined

- 21 August 2007

- Posts

- 3

- Reactions

- 0

hey

just bought at $20.50!

Couldnt be happier! it went up about 3.5% today on my buy!

Cant believe the doom sayers, BNB are a good stock.. just now its at a GREAT PRICE!!!

lol i would piss myself laughing if Macquarie made a bid for them at this lower price..

cheers

just bought at $20.50!

Couldnt be happier! it went up about 3.5% today on my buy!

Cant believe the doom sayers, BNB are a good stock.. just now its at a GREAT PRICE!!!

lol i would piss myself laughing if Macquarie made a bid for them at this lower price..

cheers

- Joined

- 2 March 2007

- Posts

- 233

- Reactions

- 0

im still way off on my buy in which was far to early at $26. Still they were Pushing $34 not that long ago. Ill be happy if they get back up to around $30 in the not so distant future. Wait.. thats almost 40% from its current position... maybe ill be waiting a while..

And might see further lows yet..

In it for the lonig run i guess!

LOL@ MBL buying BNB

And might see further lows yet..

In it for the lonig run i guess!

LOL@ MBL buying BNB

- Joined

- 3 July 2007

- Posts

- 145

- Reactions

- 0

Same story for me too - got in just last week at high 23s and thought it an absolute bargain as have been watching for a while. Then last Thursday came and $$ went!!

I'm only was only in this one for a relatively easy 10-15% but now things have changed that's for sure. Still, it's a high qual stock and it can only go up from here.....

I'm only was only in this one for a relatively easy 10-15% but now things have changed that's for sure. Still, it's a high qual stock and it can only go up from here.....

- Joined

- 28 March 2006

- Posts

- 3,566

- Reactions

- 1,309

Bought into BNBIMA instalment at 1.17 and again at 0.72. Went against my policy of buying on the way down but in the case of BNB I make an exception.

Expiry of Dec '07, they may soon announce a dividend for Oct or Nov.

Mike

Expiry of Dec '07, they may soon announce a dividend for Oct or Nov.

Mike

- Joined

- 1 February 2006

- Posts

- 568

- Reactions

- 7

Firstly, I cant see MBL making a bid for BNB due to ACCC (that rhymes!).

Also, MBL is a garbage stock, an Enron waiting to happen. Often referred to as a House of Cards - they re value their assets and then leverage against the revalues to boost EPS and pay dividends - totally unsustainable and bordering on negligent.

BNB on the other hand is quality. They simply do their business and do it welll with out any of the hidden black box magic of Macquarie. They invest, make money from management fees and returns on their investments and funds.

In short, BNB good, MBL bad.

DYOR, my opinions only.....

Also, MBL is a garbage stock, an Enron waiting to happen. Often referred to as a House of Cards - they re value their assets and then leverage against the revalues to boost EPS and pay dividends - totally unsustainable and bordering on negligent.

BNB on the other hand is quality. They simply do their business and do it welll with out any of the hidden black box magic of Macquarie. They invest, make money from management fees and returns on their investments and funds.

In short, BNB good, MBL bad.

DYOR, my opinions only.....

- Joined

- 2 March 2007

- Posts

- 233

- Reactions

- 0

Firstly, I cant see MBL making a bid for BNB due to ACCC (that rhymes!).

Also, MBL is a garbage stock, an Enron waiting to happen. Often referred to as a House of Cards - they re value their assets and then leverage against the revalues to boost EPS and pay dividends - totally unsustainable and bordering on negligent.

BNB on the other hand is quality. They simply do their business and do it welll with out any of the hidden black box magic of Macquarie. They invest, make money from management fees and returns on their investments and funds.

In short, BNB good, MBL bad.

DYOR, my opinions only.....

Pretty much why I wanted to get in on BNB and jumped gun. More I saw/read about BNB they just sounded more... professional.. Their anns were more often and made more sense to me as well, something I really liked about th em.

Just wish Id got out of MBL at $100 and used that cash for my BNB buy in.

Recovering strong again, currently $22.8.

Thats 20% in 3 days.

Pretty much why I wanted to get in on BNB and jumped gun. More I saw/read about BNB they just sounded more... professional.. Their anns were more often and made more sense to me as well, something I really liked about th em.

Just wish Id got out of MBL at $100 and used that cash for my BNB buy in.

Recovering strong again, currently $22.8.

Thats 20% in 3 days.

Hi,

I was wondering of what peoples thoughts are on these two investment banks, namely BNB? What price range do you think they may trade between for the rest of the calender year?

And Barnz, you bought MBL at $100, I still think MBL have a great model for success with some definite upside in them at these prices, but at $100 was it just a punt or something else?

I bought BNB at 18.83 on that sea-saw day the other week, IMO the only way is up for these guys. Anyway time will tell. Maybe a long time at that.

Thanks for the interesting posts.

doc

I see BNB and MBL being determined by what happens in the US

This stocks are now the scape goat for any US falls.

So in effect BNB and MBL might just be some extra leverage to the DOW in the short term whilst everyone has Sub-prime on their minds.

Was much the same with BHP and the price of Copper when BHP was $24.00

Copper falls by 5% Bhp falls by 5%.....

Even though BHP was more than just copper.

Thats the way it all works....

Long term, you would think they have enough cash to make it grow thus creating shareholder wealth.

This stocks are now the scape goat for any US falls.

So in effect BNB and MBL might just be some extra leverage to the DOW in the short term whilst everyone has Sub-prime on their minds.

Was much the same with BHP and the price of Copper when BHP was $24.00

Copper falls by 5% Bhp falls by 5%.....

Even though BHP was more than just copper.

Thats the way it all works....

Long term, you would think they have enough cash to make it grow thus creating shareholder wealth.

- Joined

- 2 March 2007

- Posts

- 233

- Reactions

- 0

Hi,

And Barnz, you bought MBL at $100,

doc

No i bought in at $81, I wish I had SOLD at $100, would have been a nice fast 20%. I didnt sell as I had planned long term and thought it would settle back to around $90.. no idea it would hit low 60s just weeks/months later!

I still pretty much had the general public view of MBL, and that it would stay strong. So like I said more I learned about it bnb sounded better.

Now I agree with Ken though - even though its not really justified for BNB as they have less interest in the area to be affected - they are coping it, right or wrong. So if/when/where this all settles will playa big part in it. Long term though, as long as something major doesnt happen, I see them continuing up in the end.

But there has to be better stocks for short term - out of the financial sector all together!

- Joined

- 22 July 2006

- Posts

- 852

- Reactions

- 1

Firstly, I cant see MBL making a bid for BNB due to ACCC (that rhymes!).

Also, MBL is a garbage stock, an Enron waiting to happen. Often referred to as a House of Cards - they re value their assets and then leverage against the revalues to boost EPS and pay dividends - totally unsustainable and bordering on negligent.

BNB on the other hand is quality. They simply do their business and do it welll with out any of the hidden black box magic of Macquarie. They invest, make money from management fees and returns on their investments and funds.

In short, BNB good, MBL bad.

DYOR, my opinions only.....

Nicks

From an accounting perspective, I couldn't agree more with you here...

To me, BNB is the pick of the investment bank style entities (i.e. MBL, CGF, AFG, etc). There are two things that really stick out for me here with BNB that make them a class above the rest -

1). Their earnings are clearly transparent and their disclosure, even down to a business segment basis, is exemplary. Mark to market revaluation are at a minimum, there satellite funds have a clear distribution policy that pays distributions from OPERATING CASH FLOW (unlike the other mob of crooks). All in all, they are capturing recurring annuity style income that is based on sound fundamentals.

2). They always deliver to the market. When they set market guidance, they deliver.

I'm not sure this is the stage in the investment cycle that you want to invest in it, but clearly in my mind this is a must have in a long term portfolio (Super, etc).

The other reason why MBL could never take out BNB is that it is almost 45% owned by it's staff - I don't think they would ever resolve to be taken over (well, over Phil's dead body anyway)!

Cheers

Nicks

From an accounting perspective, I couldn't agree more with you here...

To me, BNB is the pick of the investment bank style entities (i.e. MBL, CGF, AFG, etc). There are two things that really stick out for me here with BNB that make them a class above the rest -

1). Their earnings are clearly transparent and their disclosure, even down to a business segment basis, is exemplary. Mark to market revaluation are at a minimum, there satellite funds have a clear distribution policy that pays distributions from OPERATING CASH FLOW (unlike the other mob of crooks). All in all, they are capturing recurring annuity style income that is based on sound fundamentals.

2). They always deliver to the market. When they set market guidance, they deliver.

I'm not sure this is the stage in the investment cycle that you want to invest in it, but clearly in my mind this is a must have in a long term portfolio (Super, etc).

The other reason why MBL could never take out BNB is that it is almost 45% owned by it's staff - I don't think they would ever resolve to be taken over (well, over Phil's dead body anyway)!

Yes and another 40% is probably owned by the eastern suburbs mafia, but who knows.

- Joined

- 8 September 2007

- Posts

- 54

- Reactions

- 0

Its still good value at the moment isnt it?

Thinking of buying some on Monday (unfortunately not cashed up enough for 2k, will prolly get 1.2k worth)

Thinking of buying some on Monday (unfortunately not cashed up enough for 2k, will prolly get 1.2k worth)

- Joined

- 27 April 2006

- Posts

- 1,109

- Reactions

- 4

Has anyone noticed the rather large buys sitting on BNB this morning?

That top bid at $26 is around an $18 million dollar transaction, hedge funds, institutions, or deep pockets buying in? The top four bids bring in around $20 million of value.

No worries... just found out it is options expiry, i thought something crazy had happened! like the all ords would open up 5%

That top bid at $26 is around an $18 million dollar transaction, hedge funds, institutions, or deep pockets buying in? The top four bids bring in around $20 million of value.

No worries... just found out it is options expiry, i thought something crazy had happened! like the all ords would open up 5%

- Joined

- 28 September 2007

- Posts

- 1,472

- Reactions

- 8

Just sold my BNB @ $29.70 up 20% for me in a month. I have a real issue with taking profits, but have so often seen these things zoom up and then come crashing down.

I am now sitting on a wad of cash looking for a home - is this "sellers remorse"

Would like to get some opinions on knowing when enough profit is enough, or when to take the profits. (of course the obvious answer is never enough).

I am now sitting on a wad of cash looking for a home - is this "sellers remorse"

Would like to get some opinions on knowing when enough profit is enough, or when to take the profits. (of course the obvious answer is never enough).

Similar threads

- Replies

- 10

- Views

- 2K

- Replies

- 30

- Views

- 7K

- Replies

- 0

- Views

- 2K