- Joined

- 2 March 2007

- Posts

- 233

- Reactions

- 0

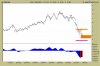

down almost 10% over the last week. might be good time to get in.

see what spare change I can find..

(while thinking I should not buy shares before moving to london without a job but also not caring so much lol)

see what spare change I can find..

(while thinking I should not buy shares before moving to london without a job but also not caring so much lol)

worth, its gotta be near the bottom (didn't someone say that earlier

worth, its gotta be near the bottom (didn't someone say that earlier