- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Guime is my handle. I have been using AmiBroker, on and off, for several years. I have learnt a lot of syntax, logic and coding in general, but I an stuck on the latest idea where I want a specific trailing stop loss. Where/how can I attach my question and sample? Thank you. I just found this window, so I hope that it works.

@Guime, welcome to the Aussie Stock Forum. I'm positive you will find the information that you are seeking if you use the search feature & search for [Trailing Stop] by member @Trav. I'm sure it will point you in the correct direction. I have attached a few hyperlinks to get you started. T%his forum is chock full of knowledge members who are willing to help. Make the search feature your best friend

Hyperlinks to read

AmiBroker Tips and Tricks

@CNHTractor you can try this code, @Trav. code slightly modified for Norgate (NDU) @Skate, thanks for that code. Yes it gets me closer to @trav but there is a difference in that @trav exploration is at a sector level, eg $XSJ, $XMJ, etc whilst your code is at the Index level $XJO. When I run...

www.aussiestockforums.com

www.aussiestockforums.com

Weekly Portfolio - ASX

@Warr87 it would be wise to read about (State verses Pulse signals) System One Check system 1 (EMA Cross) buy criteria - Is your Buy criteria (State or Impulse) ? Quick comment "Cross" is an Pulse signal, and ">" is a State signal. If you use State signals Using a State signal ">" function...

www.aussiestockforums.com

www.aussiestockforums.com

AmiBroker Tips and Tricks

Sharing a couple of things that I learnt today and should be part of your backup, as I have learnt the hard way ( as usual ) - When creating your own snippets of code Amibroker creates a new file C:\Program Files\AmiBroker\UserSnippets.xml - When creating notes for each stock Amibroker stores...

www.aussiestockforums.com

www.aussiestockforums.com

Amibroker coding

hi, i recently purchased amibroker. the coding that you need will take a long time to learn. i have tried to use some from the afl library and they dont seem to be much good written a couple of basic ones where im using ma crossovers and in back testing im getting some decent results. using...

www.aussiestockforums.com

www.aussiestockforums.com

Amibroker FAQ

This thread is for fellow Amibroker users to help each other out. If there is a very specific project you are carrying out which is likely to deviate from a general faq type thread then you are welcome to start a new thread. There was some discussion of how to use Amibroker in one of the...

www.aussiestockforums.com

www.aussiestockforums.com

The “Dump it here” thread

Also if you have the time to read a few of my posts I’m sure you’ll want to keep reading a few more

https://www.aussiestockforums.com/posts/1005967/

Live Trading results

The "Dump it here thread" post some lively trading ideas & I regularly post some ongoing live trading results. (posted at the end of the week - Friday's after 5pm)

Enjoy looking around

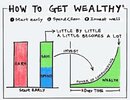

If a thread interests you, read it slowly, don't fall into the trap of "speed reading" as it doesn't give you time to fully understand the post let alone the time to memorise all the important stuff. Also, don't rush the learning process of coding a Stop Loss, your financial future may depend on it.

Free eBook - Trading Fundamentals - Skate's Beginners Version eBook

https://www.aussiestockforums.com/posts/1014728/

Enjoy looking around.

Skate.